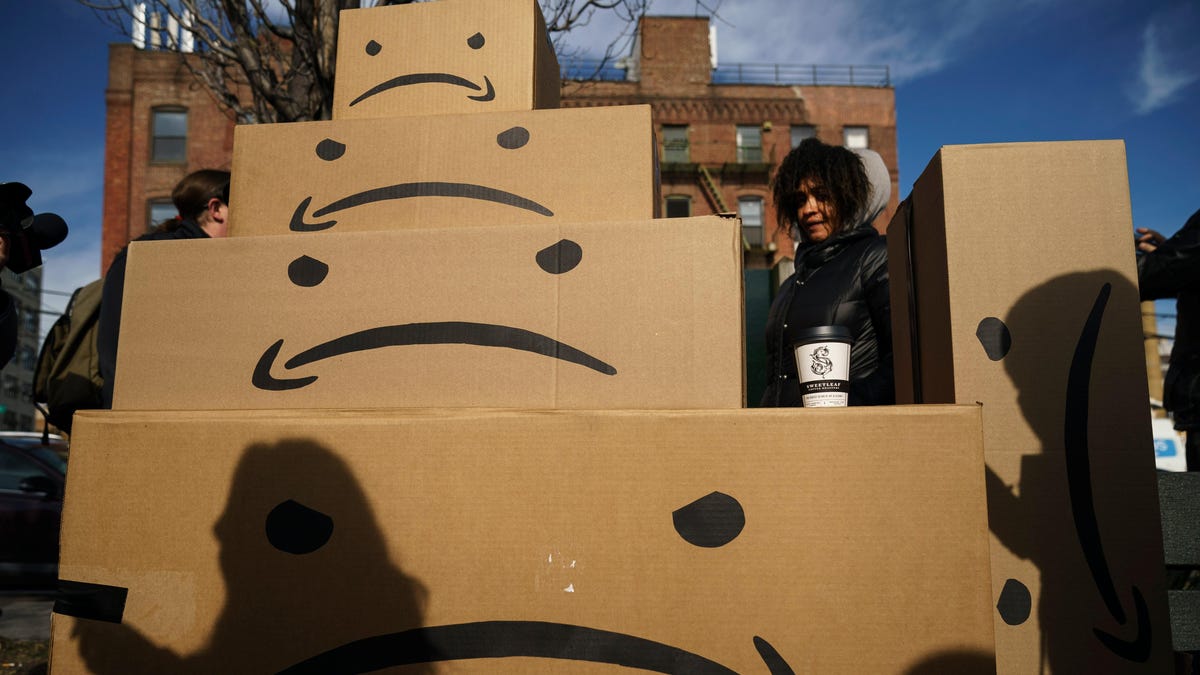

Amazon, one of many first corporations to affix the prestigious $1 trillion dollar valuation club, simply handed one other, admittedly much less fascinating milestone. This week, Jeff Bezos’ Everything Store grew to become the primary publicly traded firm to lose $1 tillion in market valuation.

Star Wars: Shatterpoint Announcement Trailer

02:27

The First Things To Do In VR, Part 3

Today 9:39AM

The thoughts boggling figures, first noted by Bloomberg, are the outcomes of a worsening economic system, repeatedly dour earnings stories, and large inventory selloffs. Amazon, valued at $1.882 trillion on June 21, on Thursday reported a relatively measly $878 billion valuation. Microsoft, which briefly surpassed Apple because the world’s Most worthy firm final 12 months, wasn’t far behind, with market valuation losses hovering round $900 billion. Combined, the 2 corporations’ declines seize the impact of a awful 12 months most in tech want to quickly overlook.

Those declines aren’t simply restricted to Amazon and Microsoft. The prime 5 Most worthy U.S. tech corporations reportedly misplaced a mixed $4 trillion in worth this 12 months. To put that in perspective, that’s greater than the combined GDPs of Turkey, Argentina, and Switzerland.

Amazon, specifically, disappointed traders final month with third quarter revenues that failed to satisfy expectations. Worse nonetheless, the corporate stated it’s anticipating to put up fourth quarter year-over-12 months progress of simply 2-8%. That’s wonderful for a traditional firm, however there’s nothing regular about Amazon which was, till now, a relentless progress machine. Like many different corporations Amazon’s additionally needed to cope with declining e-commerce purchasing as shoppers, much less involved with covid-19, start to trickle again into retail shops.

“There is obviously a lot happening in the macroeconomic environment,” CEO Andy Jassy stated following the third quarter earnings report. “And we’ll balance our investments to be more streamlined without compromising our key long-term, strategic bets.”

G/O Media could get a fee

*lightsaber hum*

SabersPro

For the Star Wars fan with the whole lot.

These lightsabers powered by Neopixels, LED strips that run contained in the blade form that permit for adjustable colours, interactive sounds, and altering animation results when dueling.

On the plus aspect, Amazon’s up to now managed to keep away from the attention popping layoffs which have impacted so a lot of its tech business compatriots. That’s to not say there aren’t causes for concern. Earlier this month, the corporate moved to broaden an earlier hiring freeze to cowl all of its company workers. In a memo, Amazon Senior Vice President of People Experience and Technology Beth Galetti cited an unsure financial outlook and an increase in hiring in recent times as the primary drivers behind the slowdown.

Zooming out, the report valuation losses arguably say simply as a lot in regards to the peculiarities of the fashionable international economic system because it does about one single firm. Just 4 years in the past, Apple grew to become the primary firm to realize the $1 trillion valuation mark. Apple someway managed to briefly triple that valuation within the years since and round a half a dozen different corporations, together with Amazon, Microsoft, Meta, and Saudi Aramco, all managed to surpass the as soon as unfathomable determine. Now, in 2022, moderately than write tales on corporations attaining that trillion greenback mark, the extra significant story facilities round those that can lose that very same quantity and nonetheless keep untoward ranges of wealth.

#Nailed #Amazon #Company #Lose #Trillion #Stock

https://gizmodo.com/amazon-market-cap-amazon-prime-e-commerce-1849764529