After the success of UPI, the NPCI (National Payments Corporation of India) formally launched UPI Lite on twentieth September 2022. UPI Lite’s goal is to scale back the burden on banks, whereas additionally rushing up the transaction time, and making it extra accessible throughout the nation. Today we are going to stroll by what’s UPI Lite, its options, and methods to use it. Additionally, you possibly can learn methods to make offline UPI funds.

What is UPI Lite?

In layman’s phrases, you possibly can name UPI Lite a Paytm pockets however for UPI. You can add stability to this UPI Lite pockets anytime you need, after which use the quantity of this pockets to pay for one thing. These transactions received’t be mirrored in your financial institution passbook and can assist you to preserve a wholesome passbook to your account. Trust me, your CA will love this. It is proscribed to the BHIM app solely, however NCPI acknowledged it could be rolled out to Paytm, PhonePe, and Google Pay quickly.

Image Credits: NCPI

Features of UPI Lite

The UPI Lite may sound like a cut-down model of UPI, nevertheless it gives a brand new set of options over UPI. These options will assist so as to add extra individuals to the UPI world and toughen the digital cost construction of India.

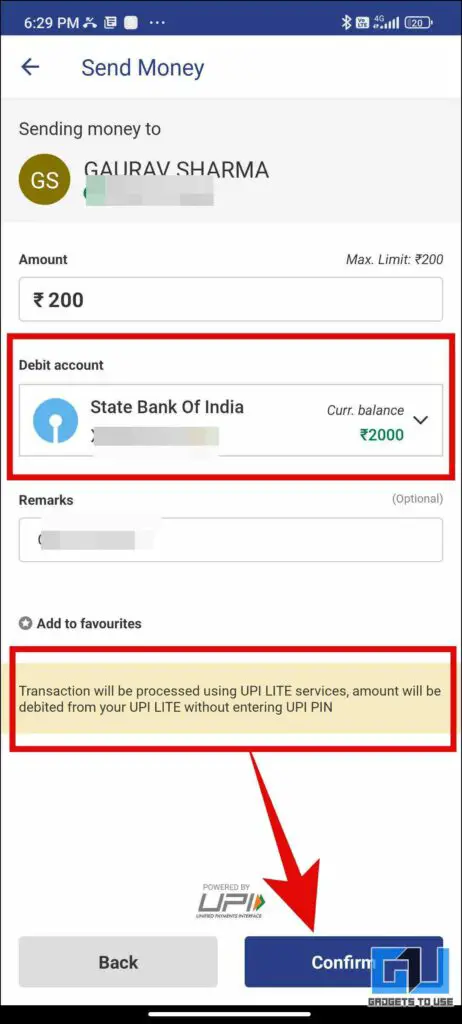

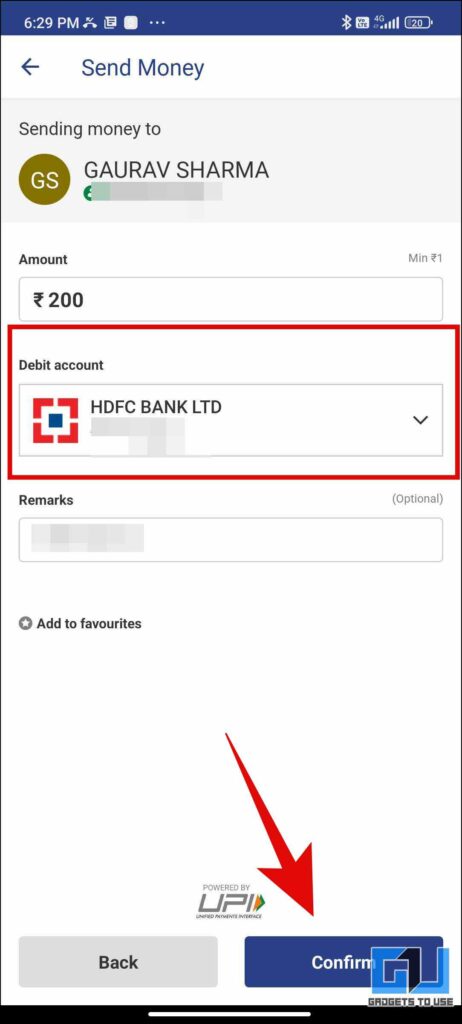

- Allows to do recurring small funds underneath INR200.

- It can maintain a most of INR 2000, with no each day restrict of pockets top-up.

- RuPay Credit Cards could be linked to UPI ID.

- No PIN is required to do the transaction (solely the app PIN is required).

- Payment could be achieved by way of UPI ID, Phone Number, or QR Code.

- Partially works offline, because the sender pays with out the web as nicely.

How to Use UPI Lite?

Now, that we’ve seen the options UPI Lite gives, let’s verify methods to activate and apply it to your cellphone. It helps each Android and iOS platforms, it may be activated from the BHIM app in your Android cellphone or iPhone. Here’s how:

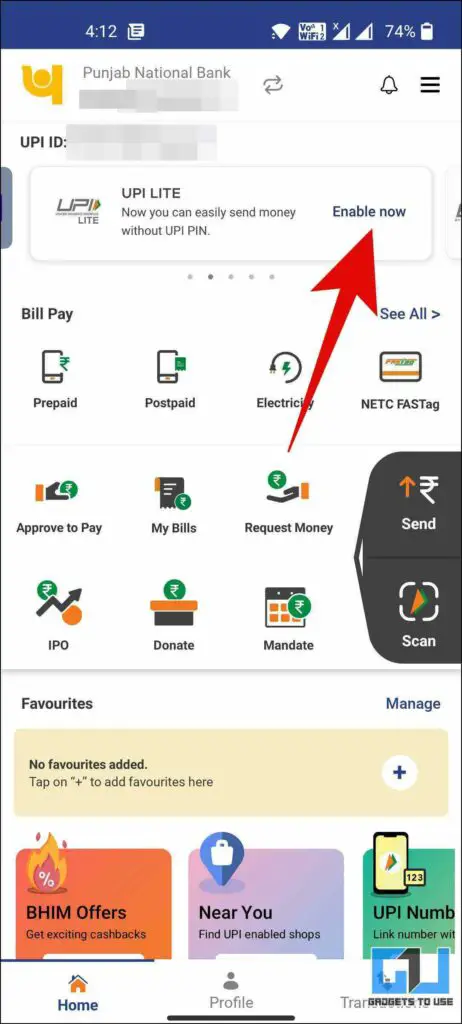

1. Launch the BHIM App (Android, iOS) in your cellphone.

2. Click the Enable Now, button from the banner on the high. If the banner doesn’t seem for you, make sure that to replace the app to the most recent model, shut the app, and re-launch it.

3. Navigate by the welcome display screen, and verify the field to agree on phrases and circumstances. Now, faucet on Enable Now.

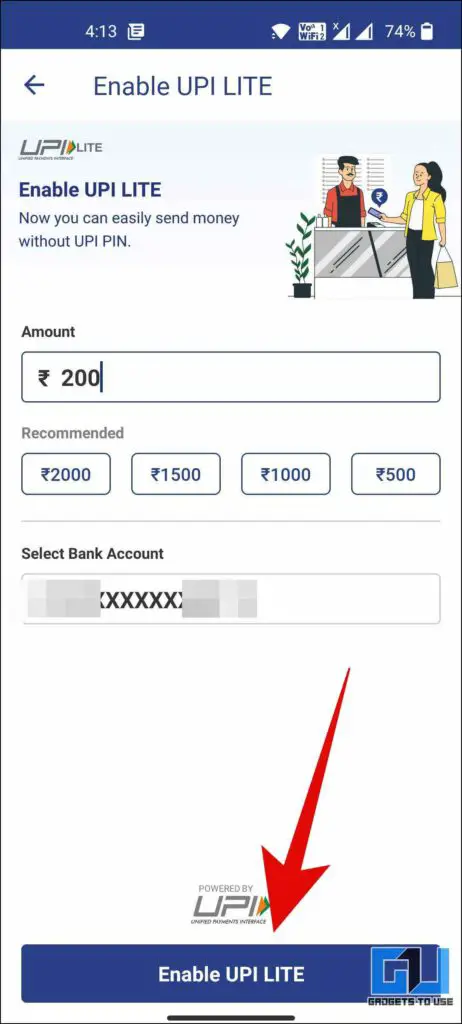

4. Choose your financial institution, from the checklist. (As of now, solely eight banks are supported, specifically, Canara Bank, HDFC Bank, Indian Bank, Kotak Mahindra Bank, Punjab National Bank, State Bank of India Union Bank of India, and Utkarsh Small Finance Bank).

5. Now, select from the accessible choices so as to add cash to your Wallet. Tap on Enable UPI Lite and enter your UPI PIN.

6. Now, your stability could be seen on the house web page. Every time you attempt to make a transaction underneath INR 200, you may be requested to pay by way of UPI Lite, nevertheless, should you want to pay by way of regular UPI, you possibly can merely use one other financial institution.

FAQs

Q: Why can’t I see Enable UPI Lite on the BHIM app?

A: Make certain you’re utilizing the up to date BHIM app, and your financial institution is within the supported checklist for UPI lite. As of now, solely Canara Bank, HDFC Bank, Indian Bank, Kotak Mahindra Bank, Punjab National Bank, State Bank of India Union Bank of India, and Utkarsh Small Finance Bank, are supported.

Q: Can I exploit my RuPay Credit Card for UPI Lite?

A: Yes, It does help RuPay Credit playing cards, the help is increasing to RuPay playing cards of all banks.

Q: Can I high up the UPI Lite Wallet stability greater than as soon as in One day?

A: Yes, you possibly can add INR 2000 as many instances in a day to your pockets.

Q: Why can’t I Pay greater than INR 200 by way of UPI Lite?

A: The most transaction quantity supported is INR 200, and it received’t ask to your UPI PIN.

Wrapping Up

In this learn, we mentioned what’s UPI Lite, its options, and methods to apply it to your cellphone. In case you’ve got made a incorrect UPI transaction, learn our information to get a refund for the incorrect UPI transaction. I hope you discovered this handy; should you did, make sure that to love and share it. Check out extra suggestions linked under, and keep tuned for extra useful guides.

You is likely to be considering:

You also can observe us for fast tech information at Google News or for suggestions and methods, smartphones & devices evaluations, be part of GadgetsToUse Telegram Group or for the most recent assessment movies subscribe GadgetsToUse YouTube Channel.

#UPI #Lite #Phone

https://gadgetstouse.com/weblog/2022/09/23/use-upi-lite-phone/