Tile, the maker of Bluetooth-powered misplaced merchandise finder beacons and, extra not too long ago, a staunch Apple critic, introduced immediately it has raised $40 million in non-dilutive debt financing from Capital IP. The funding shall be put in the direction of funding in Tile’s discovering applied sciences, forward of the corporate’s plan to unveil a brand new slate of merchandise and options that the corporate believes will assist it to raised compete with Apple’s AirTags and additional increase its market.

The firm has been a longtime chief within the misplaced merchandise finder area, providing shoppers small units they will connect to objects — like purses, baggage, bikes, wallets, keys, and extra — which may then be tracked utilizing the Tile smartphone app for iOS or Android. When objects go lacking, the Tile app leverages Bluetooth to search out the objects and might make them play a sound. If the objects are additional afield, Tile faucets into its broader finding network consisting of everybody who has the app put in on their cellphone and different entry factors. Through this community, Tile is ready to robotically and anonymously talk the misplaced merchandise’s location again to its proprietor by means of their very own Tile app.

Image Credits: Tile

Tile has additionally shaped partnerships centered on integrating its discovering community into over 40 totally different third-party units, together with these throughout audio, journey, wearables, and PC classes. Notable model partners embody HP, Dell, Fitbit, Skullcandy, Away, Xfinity, Plantronics, Sennheiser, Bose, Intel, and others. Tile says it’s seen 200% year-over-year development on activations of those units with its service embedded.

To date, Tile has bought over 40 million units and has over 425,000 paying prospects — a metric it’s revealing for the primary time. It doesn’t disclose its complete variety of customers, each free and paid mixed, nonetheless. During the primary half of 2021, Tile says revenues elevated by over 50%, however didn’t present onerous numbers.

While Tile admits that the Covid-19 pandemic had some impacts on worldwide expansions, as some markets have been slower to rebound, it has nonetheless seen sturdy efficiency outdoors the U.S., and considers {that a} continued focus.

The pandemic, nonetheless, hasn’t been Tile’s solely pace bump.

When Apple announced its plans to compete with the launch of AirTags, Tile went on file to call it unfair competition. Unlike Tile units, Apple’s merchandise may faucet into the iPhone’s U1 chip to permit for extra correct discovering by means of the usage of ultra-wideband applied sciences accessible on newer iPhone fashions. Tile, in the meantime, has plans for its personal ultra-wideband powered machine, however hadn’t been offered the identical entry. In different phrases, Apple gave its personal misplaced merchandise finder early, unique entry to a characteristic that may permit it to distinguish itself from the competitors. (Apple has since introduced it’s making ultra-wideband APIs accessible to third-party builders, however this entry wasn’t accessible from day considered one of AirTag’s arrival.)

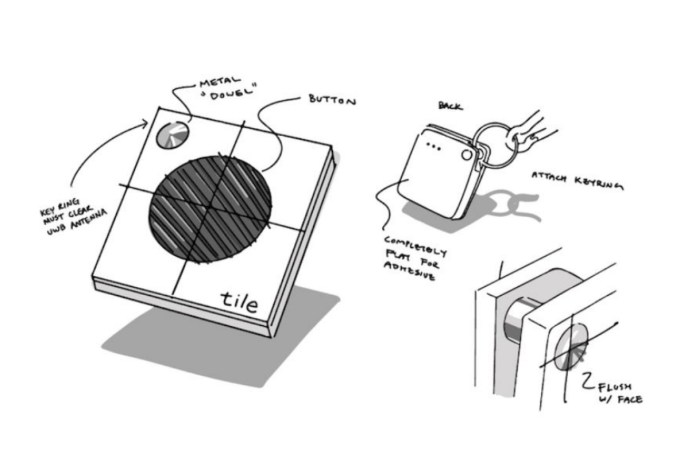

Image Credits: Tile inside idea artwork

Tile has been vocal on the matter of Apple’s anti-competitive habits, having testified in a number of Congressional hearings alongside different Apple critics, like Spotify and Match. As a results of elevated regulatory stress, Apple later opened up its Find My network to third-party units, in an effort to placate Tile and the opposite rivals its AirTags would drawback.

But Tile doesn’t need to route its prospects to Apple’s first-party app — it intends to make use of its personal app with the intention to compete based mostly on its proprietary options and providers. Among different issues, this consists of Tile’s subscriptions. A base plan is $29.99 per yr, providing options like free battery substitute, good alerts, and placement historical past. A $99.99 per yr plan additionally provides insurance coverage of types — it pays as much as $1,000 per yr for objects it may’t discover. (AirTag doesn’t do this.)

Despite its many differentiators, Tile faces steep competition from the ultra-wideband succesful AirTags, which have the benefit of tapping into Apple’s personal discovering community of probably lots of of hundreds of thousands of iPhone house owners.

However, Tile CEO CJ Prober — who joined the company in 2018 — claims AirTag hasn’t impacted the corporate’s income or machine gross sales.

“But that doesn’t take away from the fact that they’re making things harder for us,” he says of Apple. “We’re a growing business. We’re winning the hearts and minds of consumers… and they’re competing unfairly.”

“When you own the platform, you shouldn’t be able to identify a category that you want to enter, disadvantage the incumbents in that category, and then advantage yourself — like they did in our case,” he provides.

Tile is making ready to announce an upcoming product refresh which will permit it to raised tackle the AirTag. Presumably, it will embody the pre-announced ultra-wideband version of Tile, however the firm says full particulars shall be shared subsequent week. Tile may increase its lineup in different methods that may permit it to raised compete based mostly on appear and feel, measurement and form, and performance.

Tile’s final spherical of funding was $45 million in growth equity in 2019. Now it’s shifted to debt. In addition to new debt financing, Tile can be refinancing a few of its present debt with this fundraise, it says.

“My philosophy is it’s always good to have a mix of debt and equity. So some amount of debt on the balance sheet is good. And it doesn’t incur dilution to our shareholders,” Prober says. “We felt this was the right mix of capital choice for us.”

The firm selected to work with Capital IP, a bunch it’s had a relationship with during the last three years, and who Tile had thought-about bringing on as an investor. The group has remained focused on Tile and enthusiastic about its trajectory, Prober notes.

“We are excited to partner with the Tile team as they continue to define and lead the finding category through hardware and software-based innovations,” stated Capital IP’s Managing Partner Riyad Shahjahan, in a press release. “The impressive revenue growth and fast-climbing subscriber trends underline the value proposition that Tile delivers in a platform-agnostic manner, and were a critical driver in our decision to invest. The Tile team has an ambitious roadmap ahead and we look forward to supporting their entry into new markets and applications to further cement their market leadership,” he added.

#Tile #secures #million #Apple #AirTag #merchandise #TechCrunch