Paytm is usually used to set Bill Due Notifications, Auto Pay Bills, Tap to Pay, and rather more. These issues can take a toll in your finances, so limiting your bills is at all times a superb apply. While you may at all times use expense tracker apps, Paytm gives the built-in choice to restrict pockets transactions. And right here’s how one can set transaction and quantity limits in your Paytm Wallet.

Set Limit On Your Paytm Wallet Transactions

Along with the security and safety of your cash, one other advantage of organising limits in your Paytm pockets transactions is to regulate overspending for getting habits if you’re a shopaholic. Now that we’ve got understood its benefits, let’s talk about the right way to arrange a restrict in your Paytm pockets transactions.

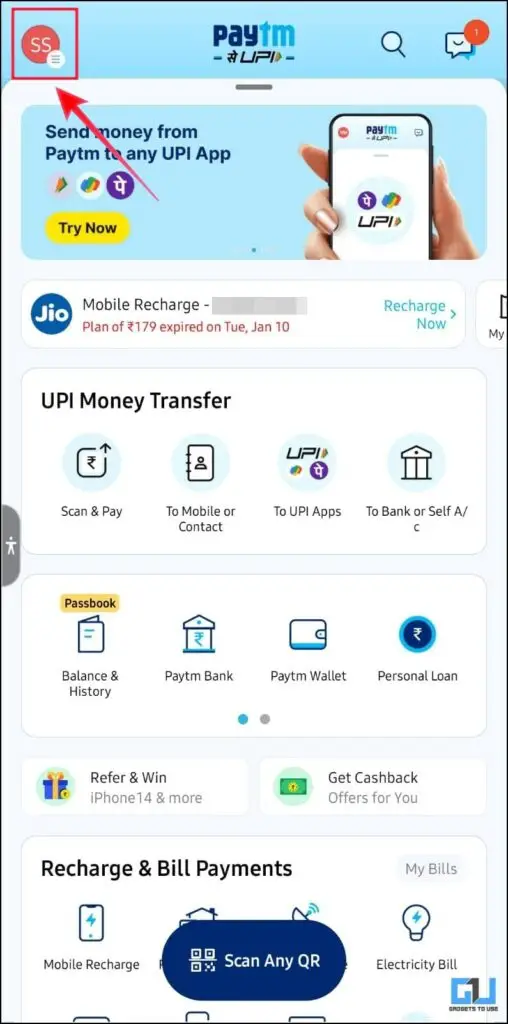

1. Launch the Paytm app (Android, iOS) and faucet on the menu (hamburger) icon.

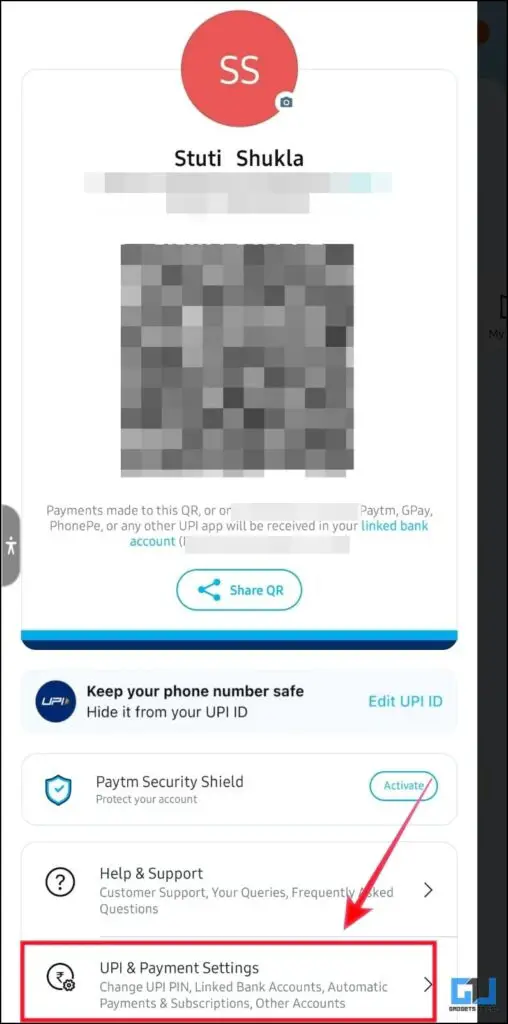

2. Under Paytm menu settings, faucet on the UPI & Payment Settings.

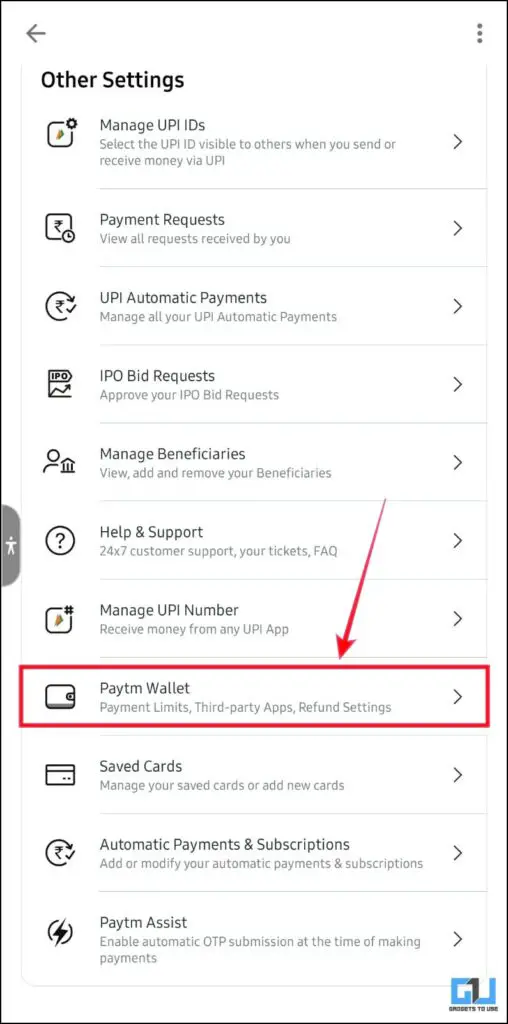

3. Now, scroll right down to the Paytm Wallet choice.

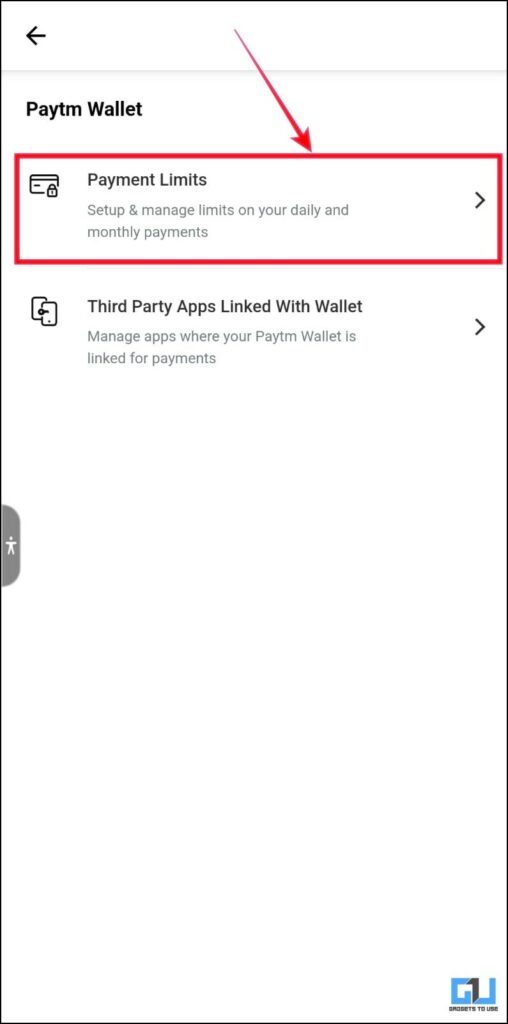

4. Under Paytm Wallet settings, faucet on Paytm Limits to arrange your day by day and month-to-month limits.

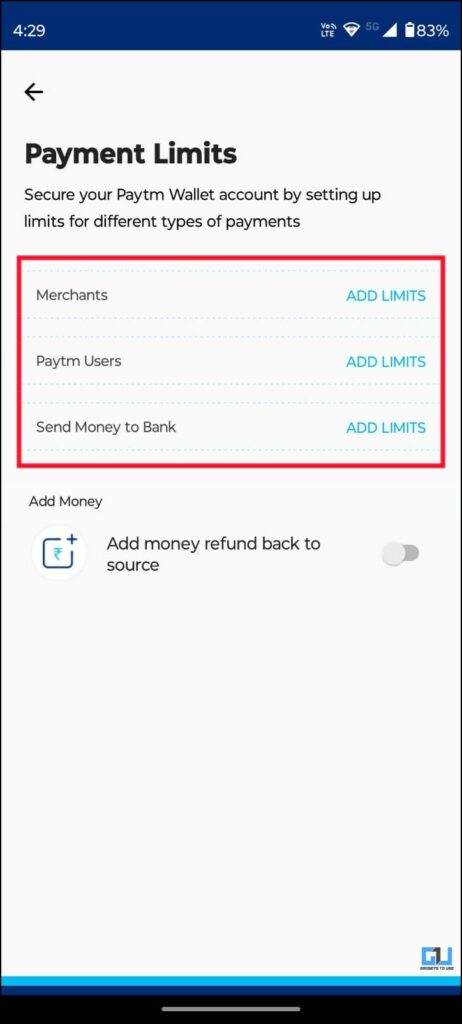

5. Now, faucet on Add Limits in entrance of the class for which you wish to set day by day & month-to-month limits. You can at the moment set limits for-

- Merchants: Transaction restrict for funds to different retailers like retailers or grocery shops.

- Paytm Users: Putting a day by day quantity or per-day transaction restrict on fee to different Paytm customers.

- Send Money to Bank: Limiting the transactions involving sending the pockets cash to your checking account.

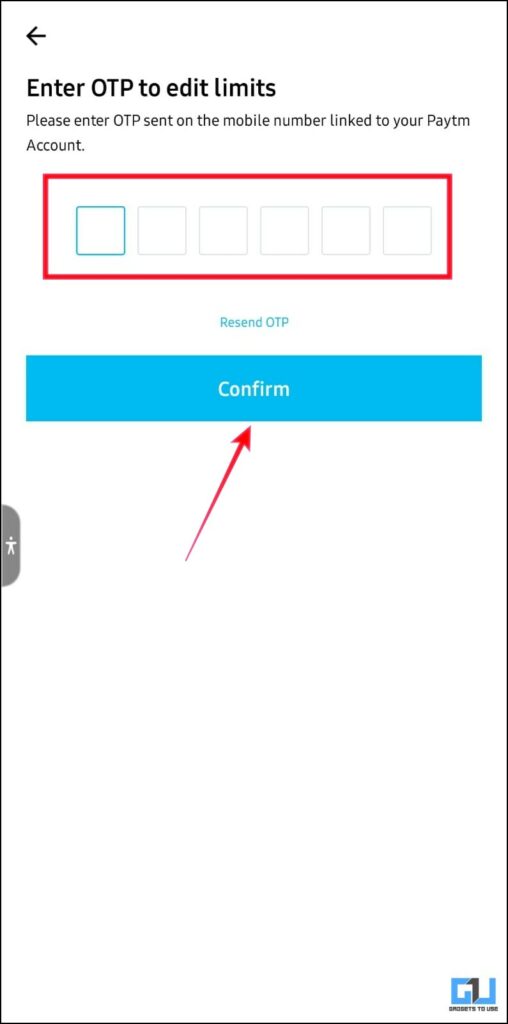

6. Verify your registered cell quantity through OTP to proceed.

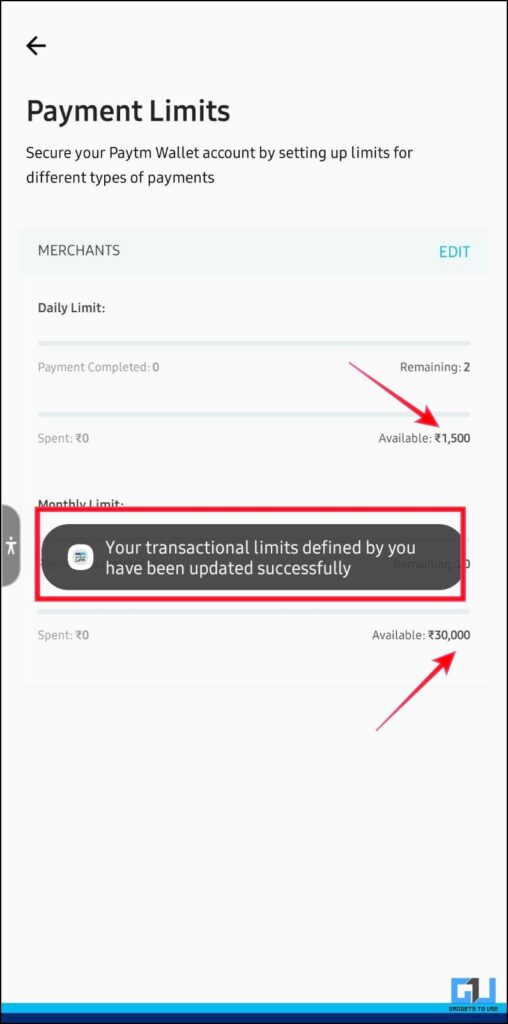

7. After Successful OTP verification, Paytm will replace your outlined limits. And you’re good to go.

Frequently Asked Questions

Q. How Much Maximum Amount Can You Keep In Paytm Wallet?

With full KYC (Know Your Consumer), you may preserve a most of INR 1,00,000 in your Paytm pockets. However, you may preserve a most of INR 10,000 in your pockets with a minimal KYC.

Q. How Much Maximum Money Can You Add/Receive to Your Wallet?

You can add or obtain a most of INR 10,000 a month and INR 1,00,000 a 12 months to your pockets if you’re a minimal KYC person, whereas a full/most KYC doesn’t have any restrict for including or receiving cash.

Q. What Is the Maximum Limit for Merchant Payments Via Paytm Wallet?

Same as receiving cash, you can also make a most fee of INR 10,000 to a service provider being a minimal KYC person, whereas there isn’t a such restrict for a full KYC person.

Q. What Is the Maximum or Full Wallet KYC?

Submitting all data for verification means that you’ve got accomplished the complete KYC. It is required to make sure that the Paytm pockets is just not used for any illegal or fraud-related actions. Upon finishing the complete KYC, you’re eligible to get pleasure from all the advantages of the Paytm Wallet.

Q. What Are the Limitations of Minimum KYC for Paytm Wallet?

A person with a minimal Paytm pockets KYC doesn’t have full entry to pockets options equivalent to on-line/offline transactions. He can entry solely restricted options whereas sustaining a stability of Rs. 10,000.

Wrapping Up

In this learn, we mentioned the fast and straightforward steps to set quantity and transaction limits in your Paytm Wallet. I hope you discovered this information helpful; if you happen to did, share it with Paytm associates. Check out different ideas linked under, and keep tuned to GadgetsToUse for extra tech ideas and methods.

You is perhaps fascinated by:

You may also comply with us for immediate tech information at Google News or for ideas and methods, smartphones & devices opinions, be part of GadgetsToUse Telegram Group or for the newest assessment movies subscribe GadgetsToUse YouTube Channel.

#Set #Transaction #Amount #Limits #Paytm #Wallet

https://gadgetstouse.com/weblog/2023/01/14/set-transaction-limits-on-paytm-wallet/