RIP FTX. The firm introduced Friday morning that they have been beginning Chapter 11, AKA reorganizational chapter proceedings. In addition, CEO Sam Bankman-Fried’s different crypto agency, Alameda Research and Weste Realm Shires Services, which is also called FTX.US, are additionally twisted up within the proceedings.

Segment of Challenger Space Shuttle Found at Bottom of Atlantic Ocean

01:05

Star Wars: Shatterpoint Announcement Trailer

Wednesday 1:23PM

The 30-year-old supposed wunderkind Bankman-Fried, as soon as thought-about one of many prime minds within the crypto sphere, additionally introduced he was vacating his chair as CEO, and that John Ray III is stepping up as head honcho. According to the official press launch, “Many employees of the FTX Group in various countries are expected to continue” through the chapter proceedings.

As of now, most FTX customers have been nonetheless unable to withdraw their funds from the alternate. In the discharge, Ray stated “stakeholders should understand that events have been fast-moving and the new team is engaged only recently,” although he did promise each stakeholder they may go ahead with “thoroughness and transparency.” That’s most likely not a lot consolation for the hundreds of FTX customers who had thousands and thousands of {dollars} in crypto saved on the FTX alternate.

How did this all begin? A report from CoinDesk made it clear that FTX had been effectively printing money utilizing its personal FTT crypto token to prop up Alameda Research, Bankman-Fried’s personal crypto buying and selling agency. A Thursday report from The Wall Street Journal clarified that FTX had used buyer’s cash to fund their personal buying and selling endeavors. Of the $16 billion buyer property beneath FTX’s management, Bankman-Fried reportedly leant half of that quantity over to Alameda so it may have interaction in dangerous crypto investments. Throughout 2022, Bankman-Fried had been propping up different failing crypto companies and shopping for up the property of failed ventures like Voyager and Celsius.

G/O Media might get a fee

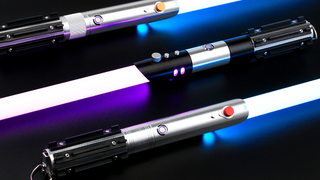

*lightsaber hum*

SabersPro

For the Star Wars fan with every little thing.

These lightsabers powered by Neopixels, LED strips that run contained in the blade form that enable for adjustable colours, interactive sounds, and altering animation results when dueling.

Once its rival crypto alternate Binance dumped its inventory of FTT, the worth of the alternate’s native coin plummeted, leading to FTX faceplanting right into a multi-billion greenback gap that it has not been in a position to pull itself out of.

It’s gone from unhealthy to worse for what was as soon as the third-largest crypto alternate by market cap. Late on Thursday, the Bahamas, the place FTX was based mostly out of, introduced its Securities Commission had frozen all of FTX’s property. According to an official release, the nation additionally suspended the corporate’s official registration.

“The Commission is aware of public statements suggesting that clients’ assets were mishandled, mismanaged and/or transferred to Alameda Research. Based on the Commission’s information, any such actions would have been contrary to normal governance, without client consent and potentially unlawful,” the Securities Commission wrote.

Bankman-Fried has put the blame on his personal shoulders, saying “I fucked up, and should have done better.” He additionally stated he overestimated the margins for the way a lot customers had on FTX. As a lot as he is perhaps inserting the blame on himself, that also received’t cease the U.S. Department of Justice and The Securities and Exchange Commission from investigating whether or not FTX’s lending merchandise have been securities, and whether or not the alternate broke any legal guidelines.

BlockFi is Caught Up in FTX’s Failure

Just just like the collapse of the Terra stablecoin seven months in the past, the calamity befalling the once-hailed crypto alternate FTX is ready to take down a number of leaders of the crypto lending area. Late on Thursday, crypto lending platform BlockFi introduced they have been halting withdrawals.

The firm tweeted they have been protecting all crypto on their platform “until there is further clarity” from the continuing collapse of once-billionaire Sam Bankman-Fried’s crypto companies FTX and Alameda Research. The firm additionally begged customers to not do any extra crypto deposits on their BlockFi wallets till they might someway, a way, type out this mess.

“We, like the rest of the world, found out about this situation through Twitter,” the corporate wrote.

In its second quarter earnings report, BlockFi stated that they had $3.9 billion in shopper property housed beneath their roof, although after all the worth of crypto fluctuates so quickly it’s laborious to inform simply how a lot crypto is perhaps squirreled away. An unnamed supply with information of the matter advised Bloomberg that BlockFi was working to maneuver its property over to FTX for custody, although the bulk hadn’t but been transferred. The firm had additionally given loans to Alameda, although the supply didn’t specify how a lot.

Earlier throughout this ongoing crypto winter, BlockFi lower 20% of its employees from all components of its firm. Later that very same month, FTX handed the exchange $250 million in credit to maintain itself afloat. At the time, FTX’s CEO Bankman-Fried stated his firm was “partnering” with BlockFi “so they can navigate the market from a position of strength.” In a Twitter thread, he additional elaborated that BlockFi was appearing preemptively to realize new money flows “before it was necessary.”

A Few Crypto Folks Considered Propping Up FTX

Binance and its CEO Chenpeng Zhao have been initially set to purchase out FTX, however after its rival’s stability sheets and apparently smelling one thing not fairly proper, Binance tanked the deal. Justin Sun, the founding father of Tron and its cryptocurrencies akin to TRX JUST, then stepped as much as doubtlessly prop up the failing firm. Sun advised Bloomberg on Friday that they is perhaps prepared to supply a multi-billion greenback inflow of support to assist the beleaguered FTX.

Sun had already struck a deal with FTX that allowed its token holders to withdraw their funds to exterior wallets, though the alternate continues to be ostensibly closed to withdrawals. Earlier this morning, Tron’s tokens have been promoting at an unlimited premium on FTX as customers labored to get their tokens off the sinking ship that’s Bankman-Fried’s prized alternate, in keeping with a report from CoinTelegraph.

#FTX #Declares #Bankruptcy #Sam #BankmanFried #Resigns #Latest #Crypto #Blowup

https://gizmodo.com/ftx-bankruptcy-crypto-sam-bankman-fried-binance-1849772418