It is TechCrunch custom to have a look at Apple’s inventory value throughout, and after its main occasions. Why? Because we get pleasure from it, and we’re at all times curious what affect the corporate’s information has on its precise monetary price. The reply is normally very, very little.

This might shock you. After all, Apple particulars its new {hardware} and software program at its confabs, which signifies that the products it intends to promote within the coming quarters are being proven off earlier than investor eyes for the primary time. Sure, Apple leaks greater than it used to, however that doesn’t imply that every part comes out early — its occasions are nonetheless occasions.

Why don’t buyers appear to care about merchandise? It’s somewhat fuzzy, however information signifies that Apple might launch something in need of a automotive and nonetheless get blanked by the capital courses.

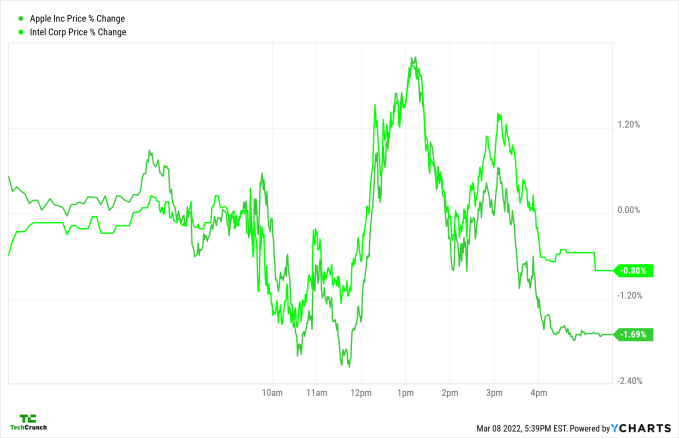

Anyway, right here’s a chart of Apple’s share value, together with value information from a Very Special Guest:

It was a wild day within the markets. Stocks have been down! Then they went up! And then they went down! If you watched the ticker-symbol world right this moment, it’s advantageous to achieve in your favourite psychoactive at this level and chill. You deserve it.

You can see those self same ups and downs within the above chart, which pits Apple and Intel in opposition to each other on a one-day timeframe. Why the 2 corporations? Because Apple launched a lot of notes on its chip work, the very business that Intel as soon as dominated from what felt like an impenetrable market place. In spite of that, Apple made many a headline right this moment because of much more new chips, and the truth that it’s constructing new computer systems to accommodate them.

So, up goes Apple and down goes Intel? Right? There was some hubbub that Intel’s shares fell when Apple introduced its M1 Ultra chip, so I charted the 2 on the identical time, and requested myself to search out the dip afterwards, with out checking timings from my notes. Good luck, yeah?

By the top of standard buying and selling, Intel really got here out forward. After Apple introduced neat new silicon.

Is the inventory market a meaningless random-number generator? No, not fully. But the above information does assist us higher perceive what the inventory market really is, not less than for the most important corporations. Namely it’s a macro-sentiment engine powered by 1,000,000 vampire computer systems, not moved about not by pedestrian issues like new telephones, however as a substitute by alchemical analyst expectations, and newly-announced share buybacks — paid for with debt, natch.

While buyers paid no consideration to what Apple introduced right this moment, I paid consideration to buyers not being attentive to what Apple introduced right this moment. What follows is my notes sheet (typos and all) from the occasion, which as you may inform led to a merely sensible piece of post-beauty poetry:

+1.57% at begin

Naz +2.11% [rebound!]

shares going up, now 1.98% AAPL

new iphone colours LOL

apple silicon – new daoly excessive +2.19

Now into the Iphoen and ipad information – again right down to 1.77% = naz +2.3%

Chips – naz falling some, apple now up simply 1.1%

Talking chips with randos, now simply up 1% — naz 1.27%

new Mac Studio – now up jsut 0.66% – naz 1.13

INTEL LOST GROUND AT 1:20 – round chip timing?

new max costly

We’ll be again for Apple subsequent occasion with one other episode of “does anything matter.”

#costly #Mac #couldnt #save #Apples #inventory #right this moment #TechCrunch