The crypto winter has swallowed one of many world’s main crypto suppliers. FTX, which up till now was ranked the third largest change by buying and selling quantity, introduced Tuesday they had been being acquired by rival change Binance, absolutely the largest change within the biz.

Binance CEO Chengpeng Zhao put the information out on his Twitter, saying that FTX got here to them for assist with a “significant liquidity crunch,” that means that the corporate was operating out of its personal money property to finance its transactions. Earlier on Tuesday, The Block reported that the change stopped processing crypto withdrawals. According to Etherscan, the final transaction on FTX happened round 10 a.m. ET.

Events have moved extremely quick. On Sunday, Zhao mentioned he was promoting off its FTT token holdings , which had been FTX’s native token price practically $529 million, calling it “post-exit risk management” and citing the Terra/Luna crash that was the unique catalyst for the May crypto market crash. Apparently, Zhao had some understanding of what was happening at FTX early on. In response to Zhao’s transfer, FTX CEO Sam Bankman-Fried tried to supply a small olive department by tweeting “make love (and blockchain), not war.”

At round 11 a.m ET Tuesday, Bankman-Fried wrote his crew was engaged on “clearing out the withdrawal backlog” which he claimed would repair the liquidity points, and promised that every one customers’ crypto property can be lined, although he didn’t give a timeframe when that may occur.

G/O Media might get a fee

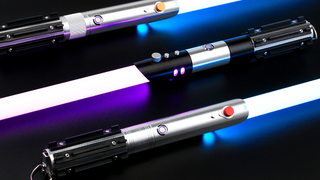

*lightsaber hum*

SabersPro

For the Star Wars fan with all the pieces.

These lightsabers powered by Neopixels, LED strips that run contained in the blade form that enable for adjustable colours, interactive sounds, and altering animation results when dueling.

Compare this to final 12 months, when SBF informed the Financial Times shopping for out huge funding banking companies like Goldman Sachs was not “out of the question,” and it’s straightforward to see how far the once-mighty have fallen.

The letter of intent is non-binding, so there’s a risk that issues might change. Zhao wrote they’ve the capability to again out at any time, although Bankman-Fried personally must do one thing to show issues round. Last week, CoinDesk first reported primarily based on inner paperwork that the FTX CEO’s personal Alameda Research, a crypto buying and selling agency, depends closely on the FTT token to outlive. Though Alameda has $14.6 billion in property, it has a base of $3.66 billion FTX token in addition to $2.16 billion in FTT collateral. The worth of FTX’s native token tanked on Monday with murmurings of liquidity points.

Just yesterday, Alameda CEO Caroline Ellison was throwing stones at Zhao and Binance for it promoting off its FTT token. Though Alameda relying so exhausting on FTX to fund its actions does level to an enormous gap in its funds that might put an enormous pressure on SBF’s crypto empire going ahead, as soon as the buyout course of commences in earnest.

There doesn’t appear to be winners anymore, not within the crypto world. Up till only a few weeks in the past, Bankman-Fried was gobbling up crypto property from different failed entities. FTX recently acquired failed crypto change Voyager’s property to the tune of practically $1.42 billion, and Bloomberg reported he was eyeing Celsius’ lingering assets as nicely. Just a couple of months in the past, the change additionally introduced it could begin letting customers commerce in shares.

FTX is definitely not the primary change to endure a liquidity disaster previously seven months. Most just lately, the Crypto platform Freeway halted withdrawals. Celsius, which was as soon as one of many largest crypto exchanges, is at present coping with allegations that it operated a Ponzi scheme. It’s now working by way of chapter proceedings.

#Largest #Crypto #Firm #Binance #Acquire #Rival #FTX #Exchange #Stops #Processing #Withdrawals

https://gizmodo.com/crypto-binance-ftx-sam-bankman-fried-1849757838