Online banking has eased out cash transfers, with the introduction of UPI it may possibly reached out to lots, as we will simply scan a easy QR code, or switch it to a cellphone quantity linked to a UPI, with the additional advantage to withdraw cash from ATM through UPI. It’s fairly frequent state of affairs, to make a transaction to a incorrect account, at the moment we’ll information you thru find out how to get refund in case incorrect UPI, or financial institution switch, and how are you going to take authorized step if wanted?

How to Get Refund in case of Wrong UPI Transaction?

If you will have made a UPI fee to a incorrect account, then you possibly can report about it from the moment alert in your cellphone through textual content. In case you haven’t obtained the textual content, then you possibly can report the transaction through the UPI app as effectively. We have coated the steps to report a transaction throughout all main UPI apps like Paytm, BHIM, Google Pay, and PhonePe.

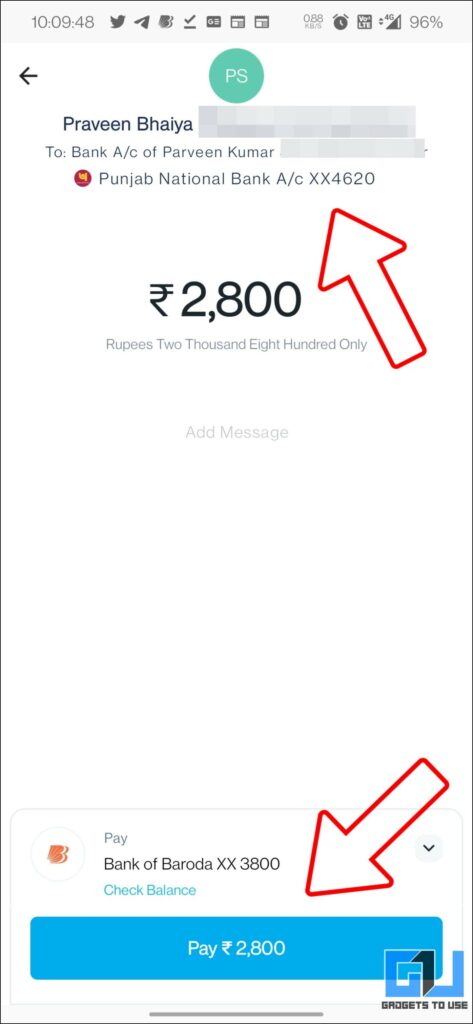

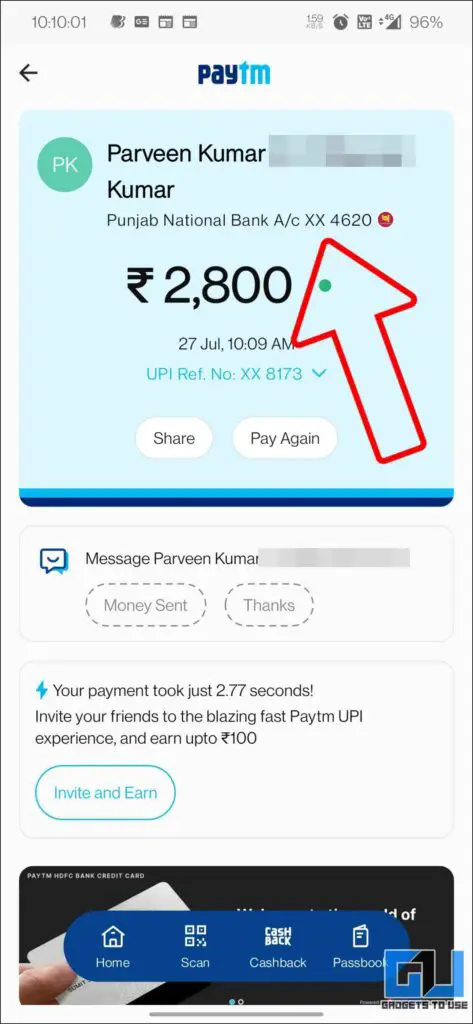

Steps to Report and Get Refund Via Paytm UPI

If you will have despatched funds to a incorrect individual through Paytm, then you must attain out to the individual instantly and ask him to return your funds. In case you aren’t capable of attain the individual, you might contact receiver’s financial institution to get his particulars for direct coordination. If you might be unable to speak to receiver, you must contact Paytm by means of 24×7 Help.

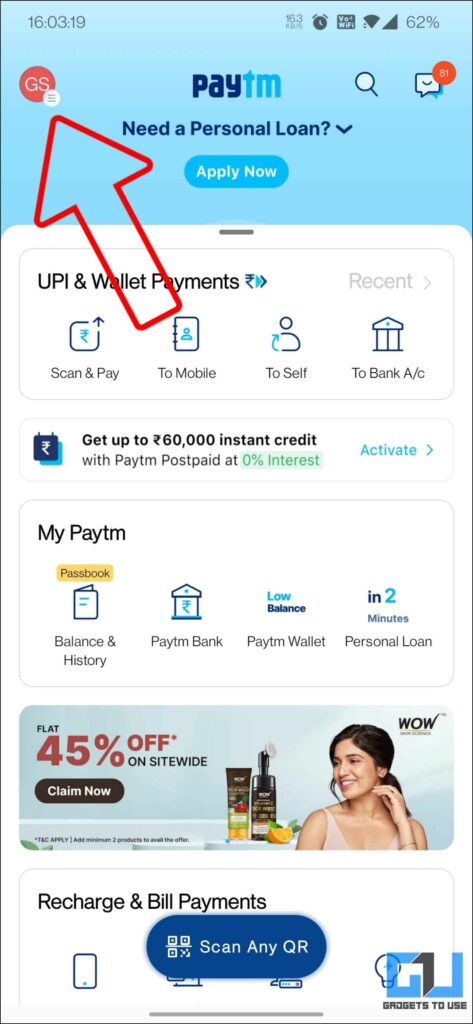

1. Tap on profile image hamburger menu from high left.

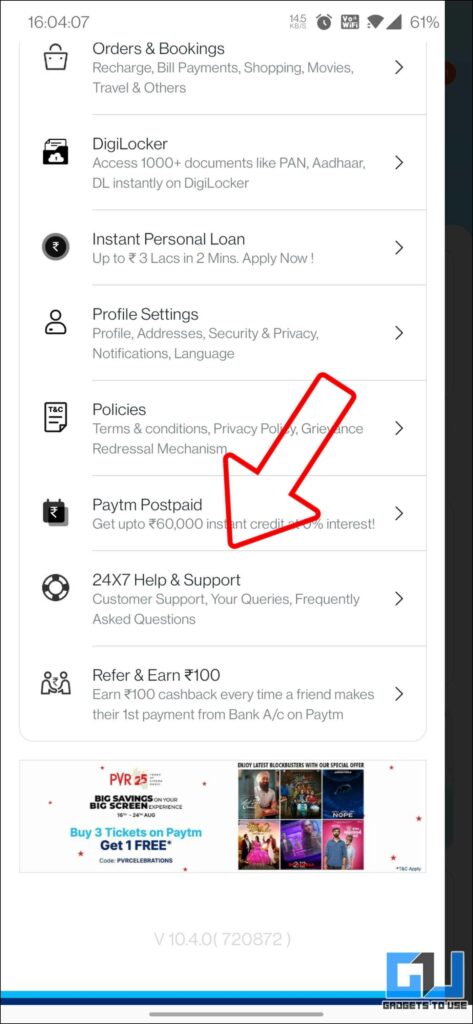

2. Scroll down, and faucet on 24×7 Help and Support.

3. Now, once more scroll down and click on on view all providers, and go to UPI Payment & Money Transfer.

4. Select the transaction you wish to report a criticism for.

5. Now, you can begin a chat with the Paytm Assistant, to lodge a criticism and provoke the refund course of.

The Paytm crew will aid you as follows:

- Payment made to Wrong Paytm Wallet, Payment Bank – If receiver has account with Paytm, i.e., both Paytm pockets or Paytm Payments Bank account, the Paytm crew would attempt to contact the receiver and on acquiring consent, shall reverse the quantity again to you.

- Receiver doesn’t have account with Paytm – If the receiver doesn’t have account with Paytm, the crew would method the receiver’s financial institution and so they shall coordinate with him. If the receiver provides consent, funds are transferred again to your account instantly.

Steps to Report and Get Refund Via BHIM UPI

If you will have made a UPI transaction to incorrect individual through the BHIM UPI app, you then comply with these steps to report the identical:

1. Tap on Hamburger Menu (three traces) from high proper.

2. Go to Raise Complaint.

3. Select the transaction you wish to report a criticism for.

4. Tap on Raise a Concern to fill in particulars on-line, or you possibly can faucet on Call financial institution to convey it over cellphone through the toll free quantity.

Steps to Report and Get Refund Via Google Pay UPI

With Google Pay used globally, it’s the popular mode for most individuals to transact with family and friends. If you will have made a UPI transaction to incorrect individual through the Google Pay app, then it may be reported to by following these steps:

1. Launch Google Pay in your Phone

2. Scroll down and click on on Show all transaction historical past, and choose the transaction you wish to report a criticism for.

3. Now, faucet on the Having points button situated on the backside. (It will present up after two days from the transaction date).

Steps to Report and Get Refund Via PhonePe UPI

In case you will have made a UPI transaction to incorrect individual through the PhonePe app, then it may be reported to by following these steps:

1. Launch PhonePe app in your cellphone.

2. Tap on the transactions historical past button from backside bar.

3. Select the transaction you wish to report a criticism for.

4. Now, click on on Contact PhonePe assist to start out a chat with the PhonePe assist assist to lodge a criticism and provoke the refund course of.

How to Get Back cash in case of Wrong Money Transfer Via Bank?

In case you will have made a fund switch to a incorrect account, instantly through your checking account and wish to get again cash, as follows:

When Account Details Entered “Does not Exist”

If the small print like MMID, cellular quantity, or account quantity, you will have made the switch to doesn’t exist in any respect, then your cash will robotically be transferred into your account. In case the account quantity exists, you’ll have to take an instantaneous motion, by contacting your financial institution supervisor.

When Account Number Entered Exist

If the account quantity you will have made the switch to belongs to somebody, who is just not the authorized recipient of the quantity, then it is advisable to comply with these steps:

1. Immediately inform your financial institution concerning the transaction inside 3 days from the transaction date, with the next particulars, to show that you simply transferred the fund to the incorrect. In some instances you may even want to go to your department.

- Transaction date and time,

- Your account quantity and

- Account variety of the recipient

- Take Screenshots as a proof

2. If the quantity has been credited to an unintended beneficiary’s account who has the identify identical as your meant beneficiary, you’ll have to present proof to assist that the switch made was incorrect.

3. To Document the method and common standing replace, write an in depth mail concerning the matter to the financial institution.

4. Since the financial institution is acts an an middleman or a facilitator, it may possibly present you particulars like department identify and make contact with variety of the incorrect recipient.

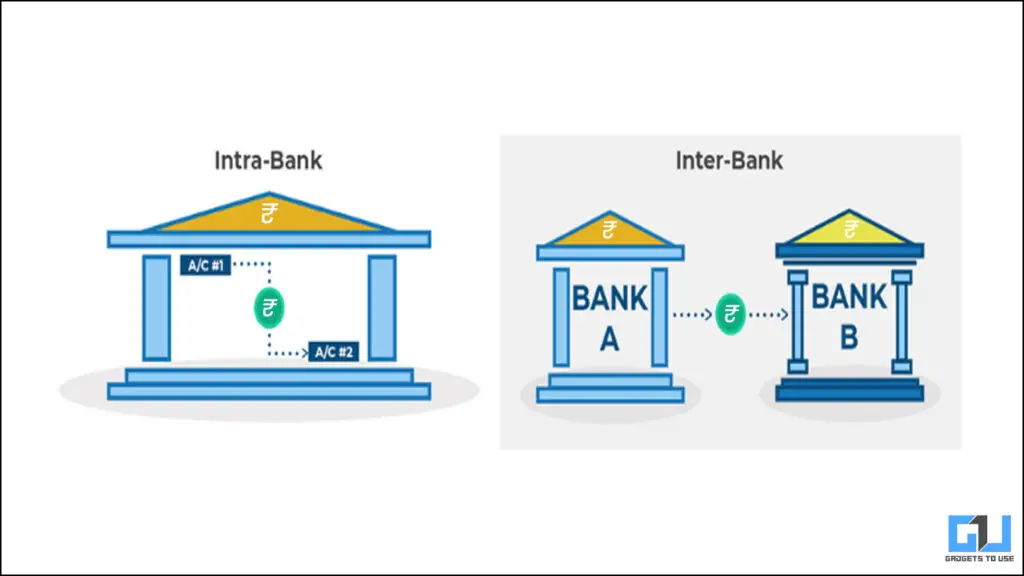

5. In case of:

- Intra-bank switch, i.e., inside identical financial institution, your financial institution might method the recipient in your behalf, and request for a reversal of transaction.

- In case of switch to a different department or financial institution, you need to personally go to the department to fulfill the financial institution supervisor to resolve the matter. The recipient’s department will request him/her for a reversal of transaction.

6. Once the beneficiary agrees, the transaction shall be reversed again inside 7 working days.

If Beneficiary Refuses to Refund the Amount of Wrong UPI or Bank Transaction

It is just not potential to reverse the switch with out the permission of the incorrect beneficiary, and practically not possible to retrieve the funds. In such a case you have to to take the authorized step as follows:

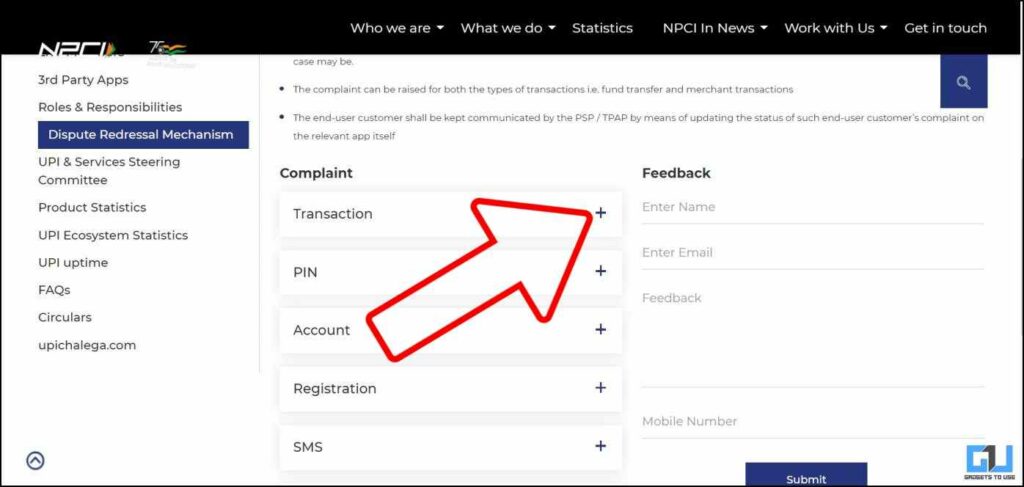

File Legal Complaint in Case of Wrong UPI Transaction

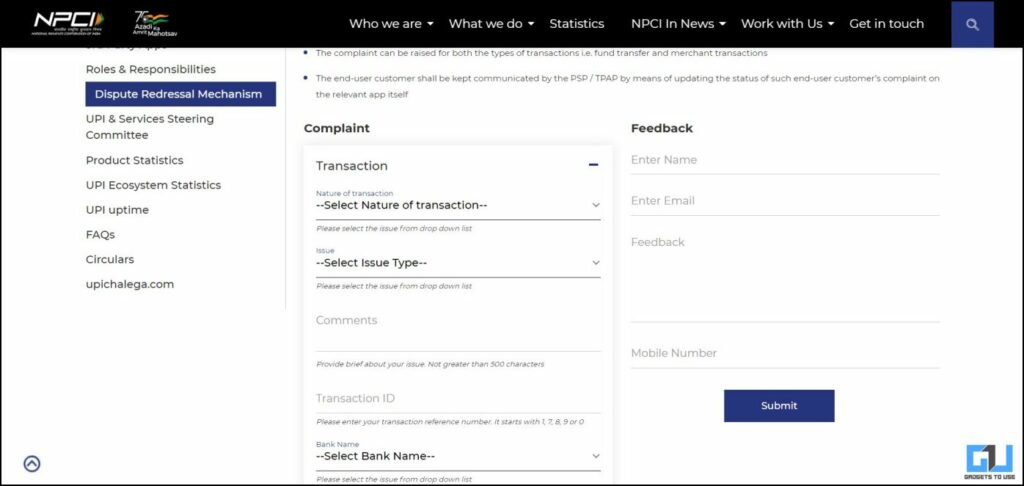

In case of UPI transaction the place the incorrect recipient of the quantity refuses to refuses to reverse the transaction, or some other case, you possibly can file a criticism, on the NCPI web site. Here’s how:

1. Visit the NCPI website in your cellphone’s or pc’s browser.

2. Under Dispute Redressal mechanism, scroll down and broaden the Transaction tab.

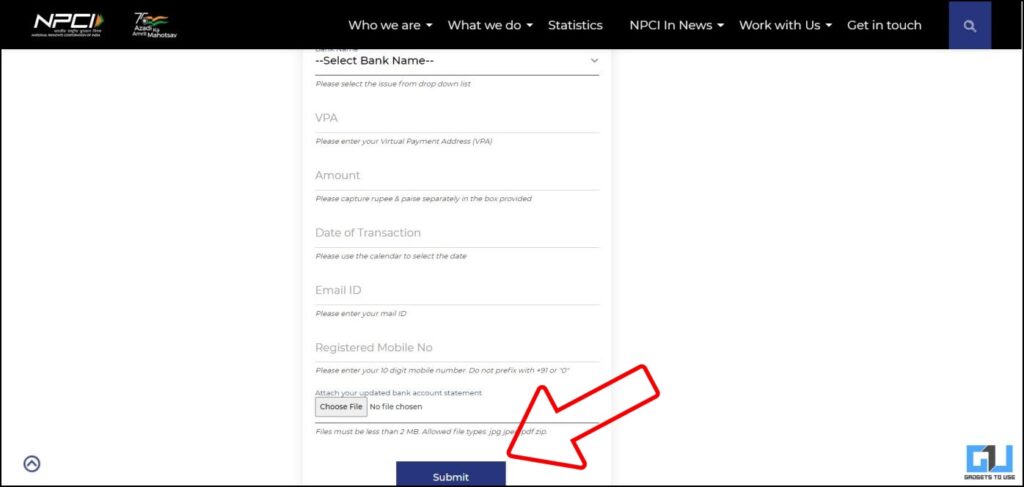

3. Enter Details like, Nature of transaction, concern, transaction ID, Bank, Amount, date of transaction, your e mail ID, and cellular quantity.

4. Attach your checking account assertion and click on on Submit.

File Legal Complaint Against Bank

As per the RBI (Reserve Bank of India) notification dated October 14, 2010, any financial institution is usually anticipated to match the identify and account quantity info of the beneficiary earlier than affording credit score to the account. However, in case of India with many various methods by which beneficiary names might be written, it turns into extraordinarily difficult to completely match the identify subject, which results in longer transaction time.

So the accountability to offer appropriate inputs within the fee directions, notably the beneficiary account quantity info, rests with the fee payer (remitter / originator). While the beneficiary’s identify shall be compulsorily talked about, the reliance shall be solely on the account quantity for the aim of affording credit score. And if the credit score has been afforded to a incorrect account, banks want to ascertain a strong, clear and fast grievance redressal mechanism to reverse such credit and set proper the error and / or return the transaction to the originating financial institution.

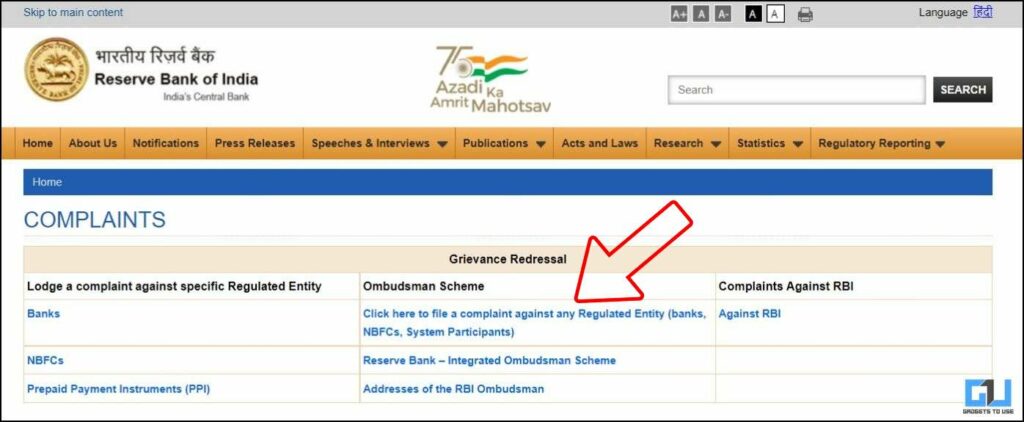

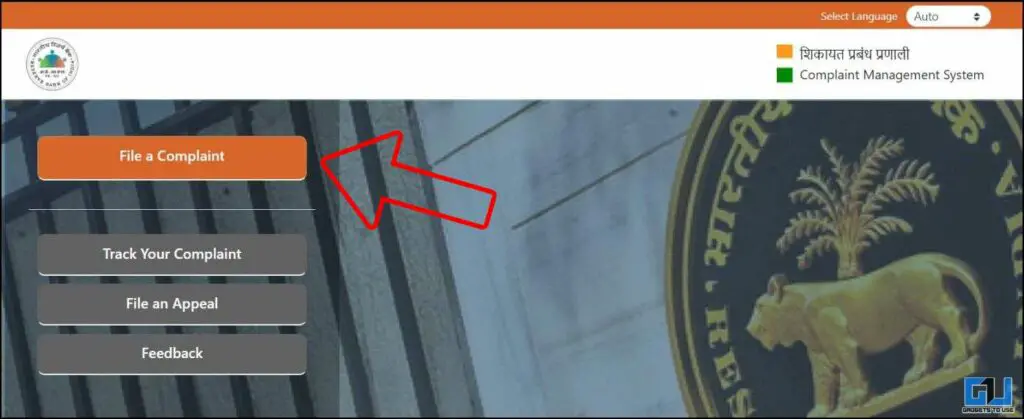

However, if the financial institution commits a mistake, and non-receipt of reply inside 30 days, or complete or partial rejection of criticism by financial institution. In such a case you possibly can file a criticism in opposition to it as on RBI’s web site as follows:

1. Visit the RBI website on a browser to register a criticism.

2. Choose the file a criticism in opposition to regulated entity.

3. Click on file a criticism and fill in particulars.

File A Complaint in Consumer Court

If you continue to don’t get a decision for the difficulty of your cash switch to a incorrect account through UPI or financial institution transaction, then you possibly can file a shopper criticism through the net portal. Check out our information to file a criticism in shopper court docket of India.

Things to Take Care of While making a UPI Transaction

You ought to care for the next issues whereas transferring any sum of cash by means of UPI or through Bank:

- Try to pay through contact quantity in case of UPI

- Always cross verify the verified particulars like Name, UPI ID, Bank Name, and Account quantity

- Always do a take a look at fee for brand new transactions

Online Transaction Safety Tips

- Avoid hackers calls or emails, don’t have interaction with unknown individual

- Keep Net Banking, and UPI PIN and passwords secret

- Change passwords periodically

- Don’t share financial institution particulars over the cellphone

- Do Not use Public Computers and Public Wi-Fi for on-line banking

- Do not click on on hyperlinks embedded in emails or textual content message

- Report misplaced playing cards instantly

Wrapping Up: Get Refund in incorrect UPI or Bank transaction

So on this article, we have now coated all of the strategies you will get refund in case of incorrect UPI and financial institution transaction. We suggest you to take further care whereas making any UPI or Bank fund switch to anybody, to keep away from any such circumstances in future. I hope you discovered this handy, if you happen to did, ensure that to love and share it, to unfold consciousness. Check out different helpful articles linked beneath and keep tuned for extra such tech ideas and trick.

You may be thinking about:

You may also comply with us for immediate tech information at Google News or for ideas and methods, smartphones & devices critiques, be a part of GadgetsToUse Telegram Group or for the most recent assessment movies subscribe GadgetsToUse YouTube Channel.

#Ways #Refund #case #Wrong #UPI #Bank #Transaction

https://gadgetstouse.com/weblog/2022/08/19/refund-wrong-upi-bank-transaction/