BNPL or Buy Now Pay Later companies are exploding in India. Domestic BNPL companies like Amazon and Flipkart Pay Later, LazyPay, Paytm Postpaid, and extra are providing credit score strains to customers with out problem, with nice reductions as icing on the cake. But is the entire Buy Now Pay Later factor as shiny as painted by the businesses? Does it have any disadvantages? Well, listed here are completely different causes to not use Buy Now Pay Later with execs and cons. We’ll additionally examine the costs of in style BNPL apps in India.

Related | 5 Best Credit Card Bill Payment Apps in India (With Cashback Offers)

What is Buy Now Pay Later or BNPL?

For starters, BNPL works equally to bank cards by providing an immediate interest-free credit score line for procuring, paying utility payments, hire, spending on meals, and extra.

It permits customers to fulfill their family bills and needs with out worrying in regards to the money in hand. On prime of it, most BNPL apps run enticing reductions and provide on e-commerce retailers and web sites.

This contains companies like Amazon Pay Later, Flipkart Pay Later, FreeCharge Pay Later, Mobikwik Zip, Simpl, LazyPay, Ola Postpaid, Paytm Postpaid, and so on., and likewise pay-later playing cards like Slice and Uni.

Reasons Not to Use Buy Now Pay Later

The earlier yr noticed Buy Now Pay Later (BNPL) schemes develop by over 600% in adoption. As per the info, it grew by 637% in 2021 in comparison with 569% development in 2020, which is quicker than what UPI clocked.

The present BNPL market is value $3-3.5 billion (Rs. 22,500-26,250 crore) and is anticipated to succeed in a whopping $45-50 billion (Rs. 3.37-3.75 lakh crore) by 2026, in keeping with PinkSeer.

This means increasingly more Indians are actually adopting BNPL over different typical modes of fee, due to its availability to folks with none credit score historical past and the advantages of reductions and quicker, one-click funds.

While BNPL appears to be a user-friendly monetary product, it additionally has some disadvantages that may be baneful if not taken care of. Here are sure cons of Buy Now Pay Later which will persuade you to steer clear of such apps and companies. Read on.

1. BNPL is a Loan

Most BNPL schemes lure clients by sugarcoating the entire Buy Now Pay Later idea. You should know that BNPL is nothing however a credit score line or a small-ticket mortgage that’s given to you and displays in your credit score report.

For these unaware, a credit score report is a detailed account of your credit score historical past. It contains details about all loans and bank cards you’ve taken to date and the reimbursement historical past.

When you enroll in a BNPL service, you’re primarily taking a private or shopper mortgage in your title, issued by associate banks or NBFCs. If you fail to repay on time, it is going to negatively have an effect on your credit score rating and your means to get loans sooner or later.

Unfortunately, there’s a extreme lack of expertise throughout signup to assist folks perceive that BNPL is a credit score product and the related issues when not repaid on time.

2. Hidden Charges & Late Payment Fee

A big chunk of earnings for the BNPL firms comes from hidden expenses and late fee charges. Some cost you an activation/ annual cost or processing payment. On the opposite hand, some cost an additional quantity on the overall invoice due.

On prime of it, all BNPL companies cost a late fee payment in case you miss the schedule. Usually, these expenses are buried below phrases and situations or have to be seemed upon within the app or website- the rationale why you shouldn’t purchase now later with out checking all the main points.

Below now we have in contrast the present schedule of expenses for in style BNPL companies in India:

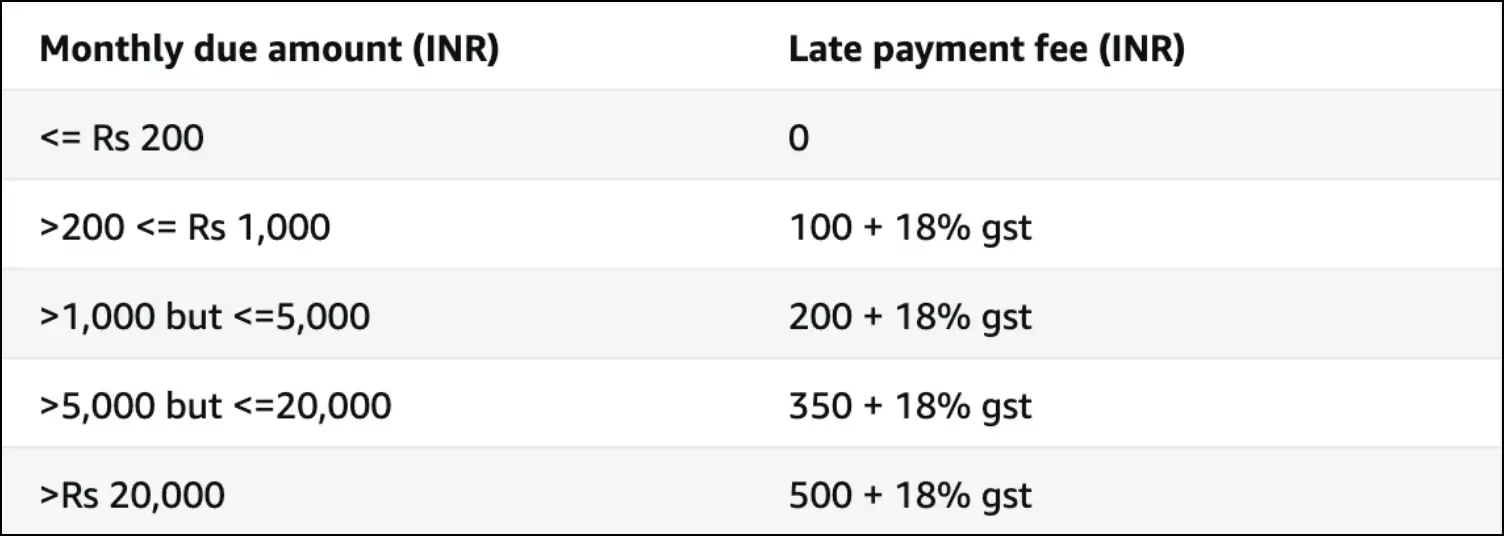

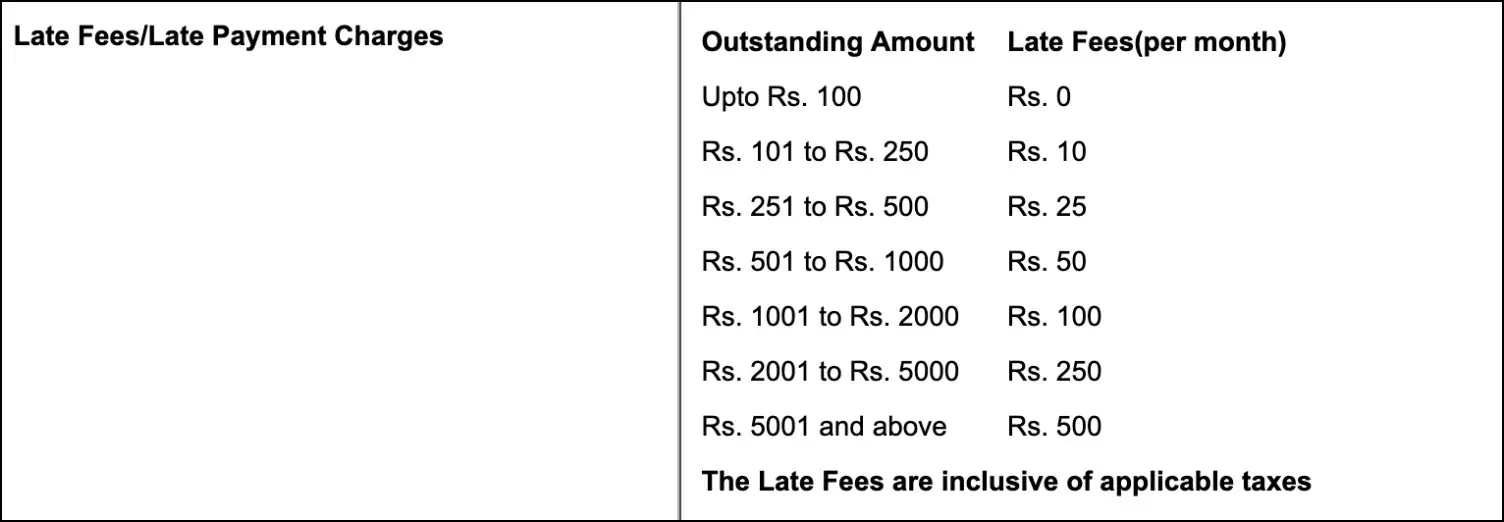

Amazon Pay Later Charges

Amazon presents an interest-free credit score line to buy and pay payments on Amazon. You also can use Amazon Pay Later for paying in EMIs. While the large doesn’t take any processing payment or foreclosures cost, it does cost a late fee payment.

Since it requires an auto-repayment setup, your financial institution could cost a one-time mandate setup cost. If your checking account doesn’t manage to pay for on the date of auto-debit, you may be charged a penalty for delay in fee from Amazon.

The late fee payment is zero for quantities lesser than Rs. 200. For increased quantities, it varies between Rs. 100 + 18% GST to Rs. 500 + 18% foundation the slabs proven within the chart above. On prime of it, your financial institution could impose ECS/ ACH bounce expenses because of inadequate stability.

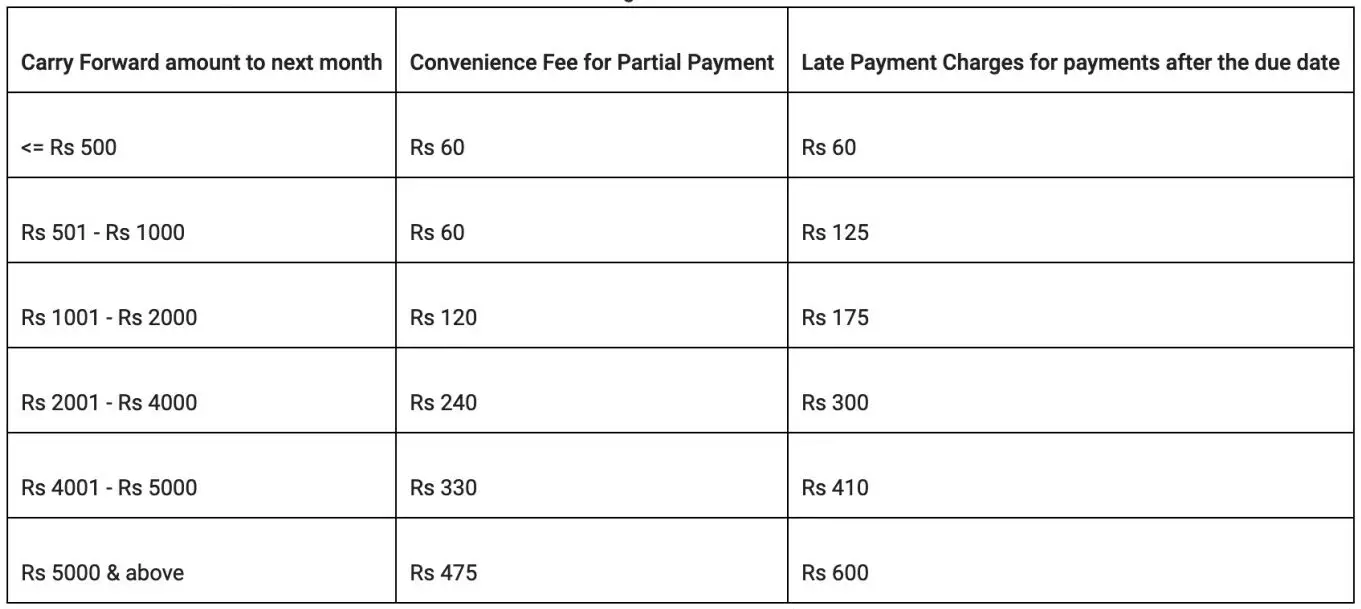

Flipkart Pay Later Charges

Flipkart Pay Later expenses a nominal utilization payment of Rs. 10 for Flipkart Pay Later payments higher than Rs. 1,000. The late fee payment, however, varies between Rs. 60 for payments to as excessive as Rs. 500 for payments ranging Rs. 5000 and above.

Flipkart additionally permits customers to pay a partial quantity and carry ahead the remaining quantity to the following month by paying a comfort payment starting from Rs. 60 to Rs. 475, as proven within the chart.

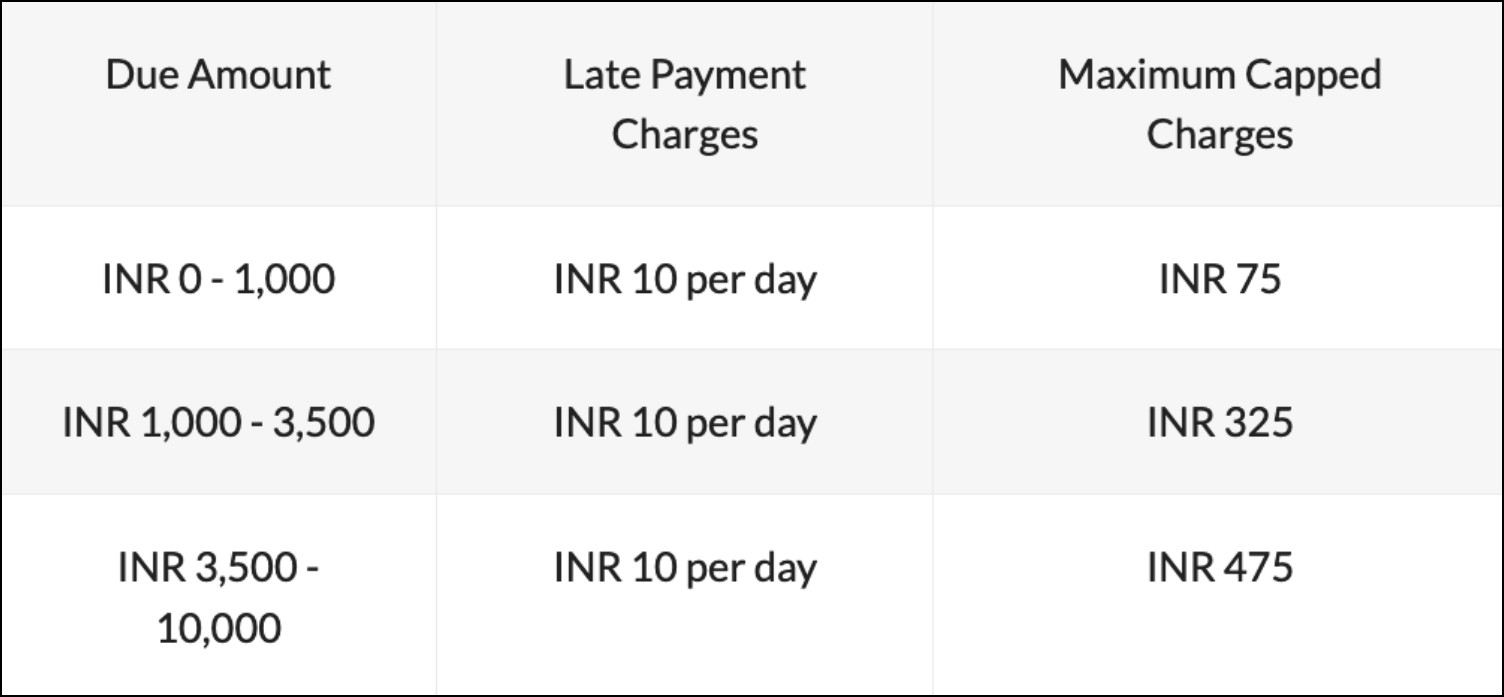

FreeCharge Pay Later Charges

Axis Bank, which powers the FreeCharge Pay Later, expenses curiosity on the quantity used. The relevant curiosity quantity is added to the overall due quantity.

However, the equal curiosity quantity is credited as cashback in Freecharge Wallet on profitable reimbursement. The rate of interest is 7.95% pa however can differ and is communicated to clients throughout enrollment.

Furthermore, a late payment of Rs. 10 per day will likely be charged in case you fail to repay the quantity on the due date, i.e., the fifth of the month.

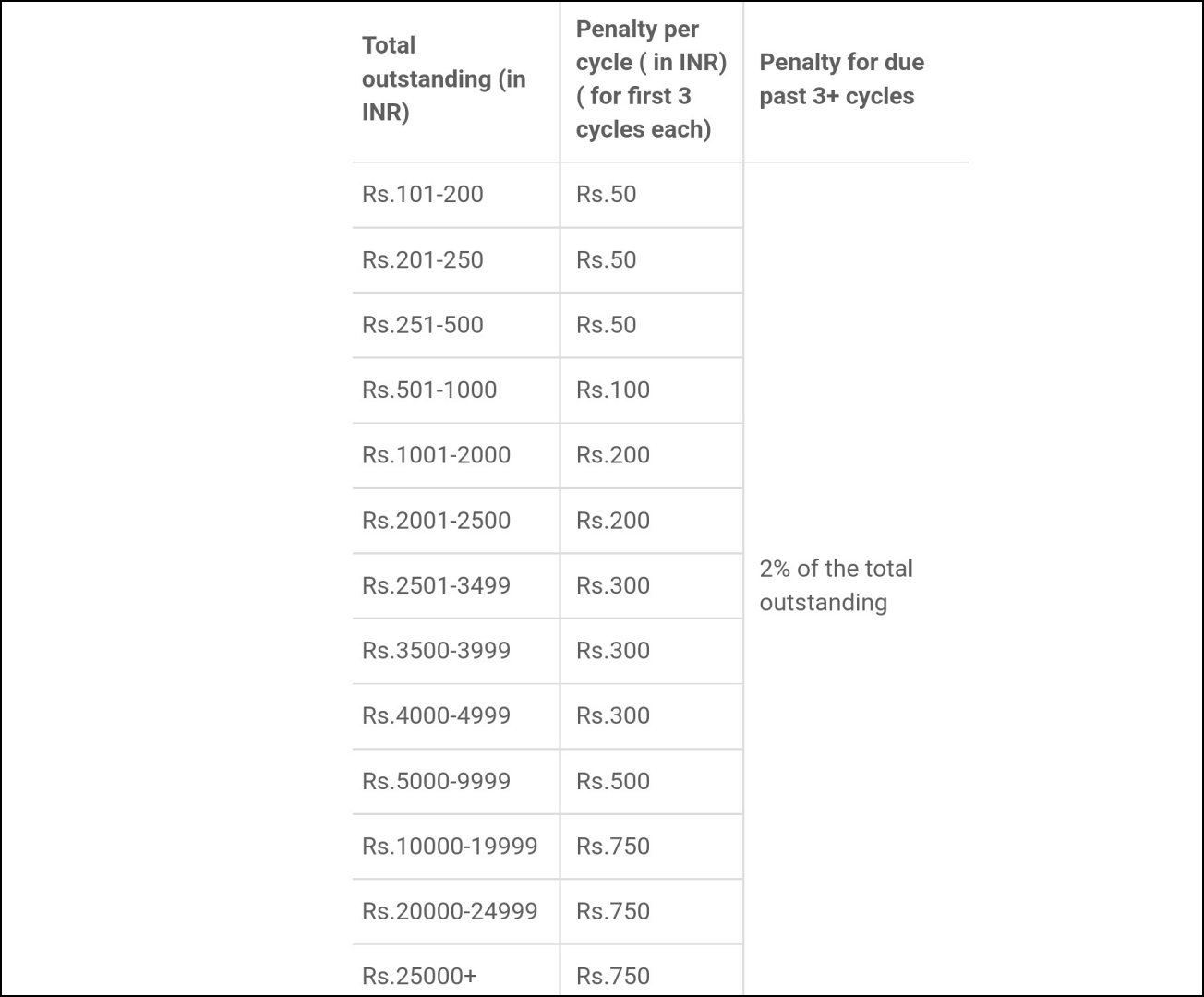

Mobikwik Zip Charges

Mobikwik Zip expenses a one-time activation payment of Rs 99 that have to be paid throughout the first invoice era. Apart from it, the scheme expenses a penalty of late reimbursement primarily based on slabs starting from Rs. 50 to as excessive as Rs. 750- the latter is for due quantities increased than Rs. 10,000.

If the due continues previous three or extra fee cycles, Mobikwik Pay Later will impose a direct 2% penalty of the overall excellent quantity.

To examine detailed expenses, open Mobikwik App > See all companies > Zip/ Pay Later > Tap Check T&C right here.

Paytm Postpaid Charges

Paytm Postpaid, one other in style BNPL service in India, doesn’t cost any late reimbursement payment for dues lower than Rs. 100. However, for increased quantities, the penalty ranges from Rs. 10 to Rs. 500, as proven within the chart above.

The large additionally has tiers known as Postpaid Mini, Lite, and Postpaid Delite, whereby the Mini and Lite have a comfort cost on the overall spend of about 1-3%.

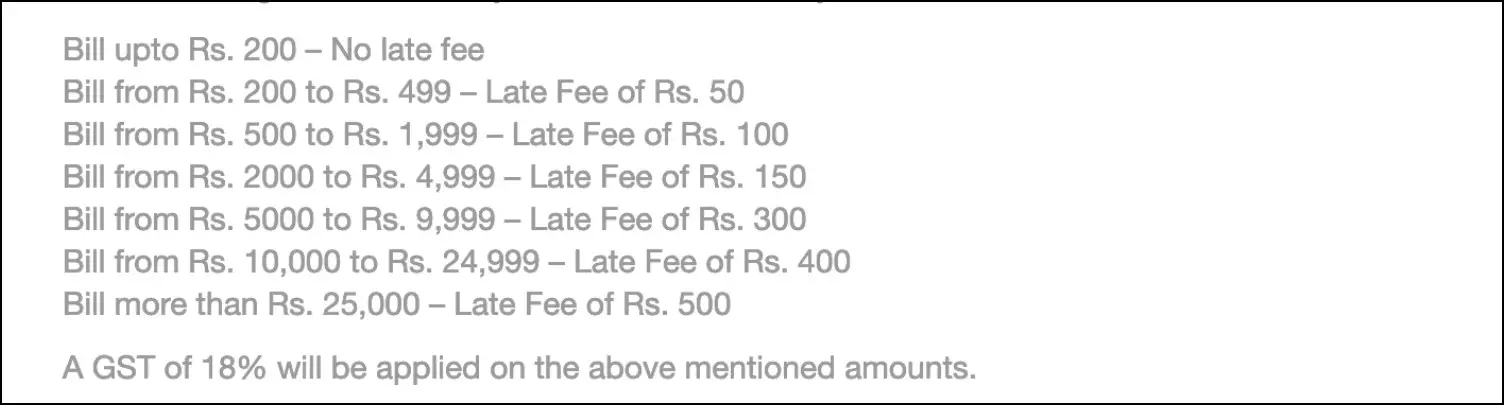

LazyPay Charges

LazyPay, which additionally gives a card in your credit score line, expenses late fee charges primarily based on completely different slabs. It begins at Rs. 50 for payments between Rs. 200 to Rs. 499, and maxes out at Rs. 500 for dues over Rs. 25,000. An extra 18% GST will likely be relevant as nicely.

If autopay is enabled, your financial institution can also impose bounce expenses in case of inadequate stability within the account on the reimbursement date.

LazyPay additionally helps Part-payment, permitting you to pay your invoice and carry ahead the remaining quantity partially. The remaining quantity is added to the following billing cycle with 1.5% carry-forward curiosity expenses, offered you’ve paid the minimal quantity due, which is 5% or Rs. 500, whichever is increased.

If you haven’t paid the minimal quantity due, you may be charged each the late payment and a carry-forward curiosity.

Simpl Pay Later Charges

If you don’t repay by the due date, Simpl can cost a late penalty of as much as Rs. 250 plus the relevant GST. However, Simpl mentions that in case the consumer informs about any problem they’re is dealing with, they might withhold the late penalty or reverse it, relying on the scenario.

It additionally notifies the consumer a number of occasions by way of Email, SMS, and different reminders earlier than levying the penalty.

Slice Pay Charges

Slice expenses a late fee payment previous the fourth day of the installment turning into overdue. The firm expenses a default cost of Rs. 35 a day which, if continued, is topic to a most restrict of Rs 2,000 or 30 p.c of the excellent quantity.

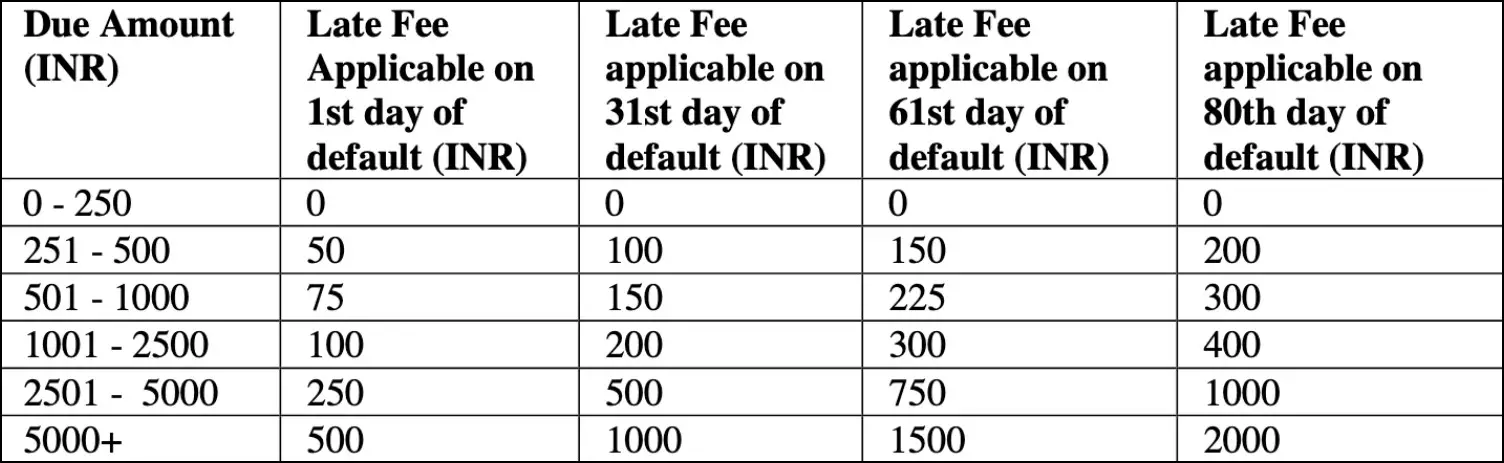

OlaCash Postpaid Charges

If you fail to make funds as per the reimbursement schedule, OlaCash Postpaid expenses a late fee payment beginning at Rs. 50 to as excessive as Rs. 2000.

Ola has set completely different slabs for delay expenses foundation the quantity due and what number of days have handed. If you don’t pay the quantity, the penalty will increase 3 times on the thirty first, 61st, and eightieth day of default.

Note: The expenses could change in the end of time. Please confirm them on the BNPL service’s official app or web site.

3. Higher Probability of Missing Repayments

Unlike bank cards, you can not resolve the billing cycle for many BNPL schemes. There’s a hard and fast reimbursement schedule, and for some schemes, it’s twice each month with a reimbursement window of 3-5 days.

If you’ve enrolled in too many BNPL schemes, monitoring and maintaining with repayments could be a problem. This is a significant purpose why many individuals miss their dues and find yourself paying the late fee payment.

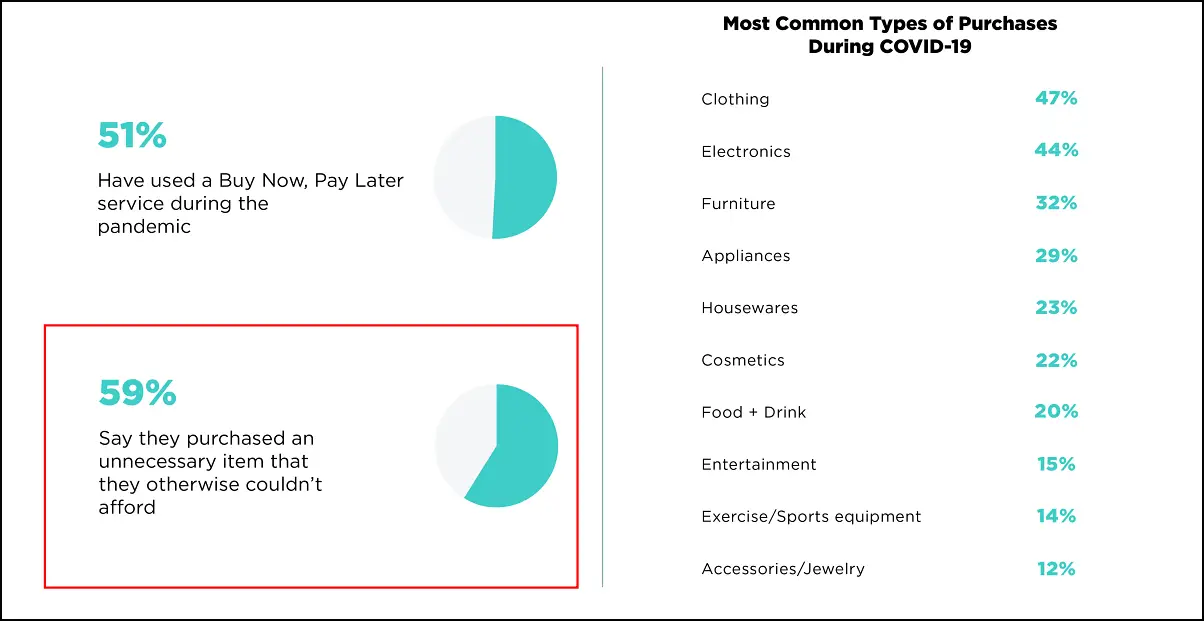

4. BNPL Encourages Overspending

According to a survey by C+R Research, out of the folks that made on-line purchases throughout the pandemic utilizing the BNPL service, 59% have accepted that they bought an pointless merchandise they in any other case couldn’t afford.

Similarly, a survey carried out on over 1,500 folks by US-based The Strawhecker Group reveals that 39 p.c of shoppers have tried BNPL. Of these, 55 p.c are likely to spend greater than different fee strategies.

The BNPL’s one-click processing and versatile repayments make folks go for giant ticket purchases than they want or can afford. The BNPL’s flexibility makes you extra inclined to spend despite the fact that you’ll be paying the quantity in a number of installments.

Hence, because it’s the case with bank cards, BNPL could unknowingly flip you into spending extra on pointless issues.

5. Disturbs Budgeting

Apart from overspending, another excuse to not use Buy Now Pay Later is that it disturbs budgeting. When you pay at a number of retailers or companies with BNPL, it turns into tough to maintain observe of your spending, particularly with the concurrent installments and repayments.

That mentioned, in case you do discover it difficult to maintain observe of your bills, you may resort to utilizing the expense tracker apps given right here.

Does BNPL Cause a Drop in Credit Score?

In common, in case you pay your dues well timed, you received’t have any damaging influence in your credit score or CIBIL rating. However, some Flipkart Pay Later customers have reported that their fee, despite the fact that made on time, was mirrored as late fee on CIBIL report thereby decreasing the credit score rating.

Also, purchase now pay later companies normally have very excessive rates of interest and expenses in comparison with a conventional financial institution mortgage. And therefore, they might push you quicker right into a debt lure which may have an effect on your credit score rating.

Pros and Cons of BNPL

Pros

- Convenient and quick funds.

- Timely funds will help constructed credit score historical past.

- Interest-free phrases.

Cons

- High late fee payment and hidden expenses.

- Encourages overspending and impulsive purchases.

- Shows up as shopper mortgage on credit score report.

Should You Not Use Buy Now Pay Later At All?

Buy Now Pay Later is a versatile product- it could possibly assist folks with unstable pay handle their money flows, and people with no/ low credit score scores get pleasure from an interest-free credit score line. But on the similar time, it has disadvantages too.

If you fail to repay on time, you’ll need to take care of hefty late fee expenses and a dent in your credit score rating. Subconsciously, it additionally makes you spend extra on the issues that you just’d haven’t purchased in any other case. On prime of it, cancellations, refund-related processing, and customer support with these BNPL companies are different complications to take care of.

Overall, if you end up financially disciplined and conscious of BNPL as a product and its penalties, there’s no hurt in utilizing it for added flexibility and reductions. But if there’s the slightest likelihood of you lacking the fee, you shall keep away from enrolling in these schemes.

Here are a few of the greatest Buy Now Pay Later apps in India, with execs, cons, and expenses intimately.

You also can observe us for fast tech information at Google News or for suggestions and tips, smartphones & devices evaluations, be part of GadgetsToUse Telegram Group, or for the newest overview movies subscribe GadgetsToUse Youtube Channel.

#Reasons #Buy #Pay #Pros #Cons

https://gadgetstouse.com/weblog/2022/11/21/reasons-not-to-use-buy-now-pay-later/